Here are comparative statement data for Crane Company and Sheridan Company, two competitors. All balance sheet data are as of December 31, 2017, and December 31, 2016.

Crane Company Sheridan Company

2017 2016 2017 2016

Net sales $1,855,000 $596,000

Cost of goods sold 1,063,000 291,000

Operating expenses 265,000 89,000

Interest expense 8,600 3,200

Income tax expense 74,900 35,000

Current assets 534,599 $512,352 136,671 $130,326

Plant assets (net) 863,952 820,000 229,154 206,332

Current liabilities 08,773 124,337 57,971 49,661

Long-term liabilities 186,944 147,600 48,577 41,000

Common stock, $10 par 820,000 820,000 196,800 196,800

Retained earnings 282,834 240,416 62,477 49,197

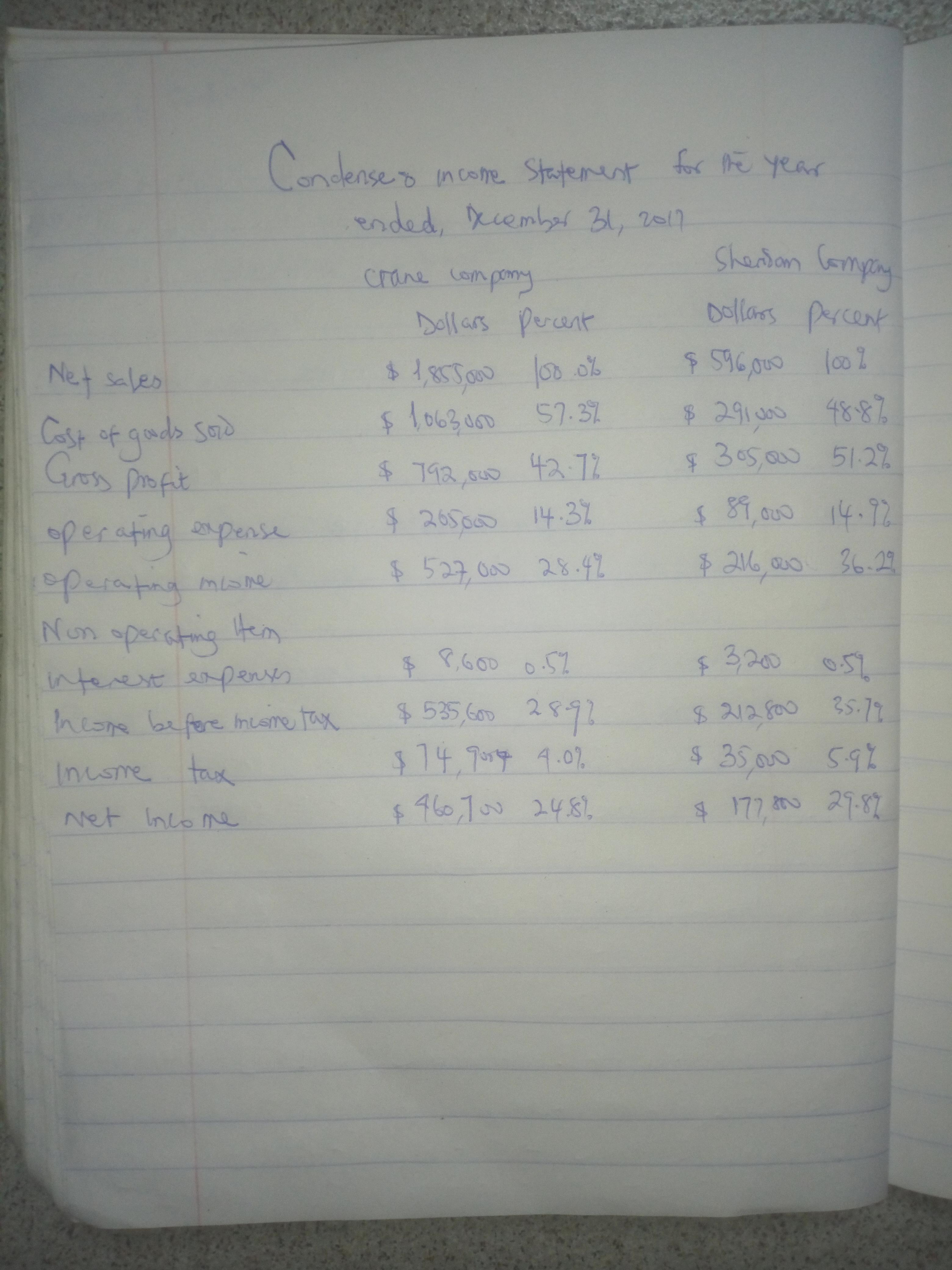

Prepare a vertical analysis of the 2017 income statement data for Crane Company and Sheridan Company.

Answers

Answer:

Please see attached.

Explanation:

Please see attached vertical analysis of the 2017 income statement data for Crane company and Sheridan company.

Note: The percent for each company - Crane and Sheridan is arrived at by dividing each item( expense or income) by sales multiplied by 100.

For instance for Crane, the percentage for Gross profit is = ($792,000 / $1,855,000 ) × 100

= 42.7%

Related Questions

A diet is to contain at least 3640 mg vitamin C, 2190 mg Calcium, and 2170 calories every day. Two foods, a dairy-based meal and a vegan option are to fulfill these requirements. Each ounce of the dairy-based meal provides 40 mg vitamin C, 30 mg Calcium, and 10 calories. Each ounce of the vegan option provides 60 mg vitamin C, 30 mg Calcium, and 50 calories. If the dairy-based meal costs $0.21 per ounce and the vegan option costs $0.27 per ounce.

Required:

a. How many ounces of each food should be purchased to minimize costs?

b. What is that minimum cost (per day)?

Answers

Answer:

(A) 73 ounces of diary-based meal and 28.8 ounces of the vegan option.

(B) The minimum cost per day is [73 × 0.21] + [28.8 × 0.27] = 15.33 + 7.776 = $23.106

Explanation:

First thing to note is that the dairy-based meal costs less than the vegan option. In otherwords, if you're to minimize cost, you should purchase as many ounces of dairy-based meal as possible. This is the first mindset or step.

What the diet should contain everyday:

3640mg - Vitamin C

2190mg - Calcium

2170 - Calories

DAIRY BASED:

(40 × 91 = 3640), (30 × 73 = 2190), (10 × 217 = 2170)

VEGAN OPTION:

(60 × 60.67 = 3640), (30 × 73 = 2190), (50 × 43.4 = 2170)

Getting 73 ounces of dairy-based meal, you have

(40 × 73), (30 × 73), (10 × 73) = 2920mg, 2190mg, 730 calories.

You have left 720mg of Vitamin C and 1440 calories to obtain from the Vegan Option.

(60 × 12 = 720), (30 × 0 = 0), (50 × 28.8 = 1440)

The highest quantity needed here is 28.8 ounces of calories from the vegan option, hence 28.8 ounces of the vegan meal should be purchased. There will be excesses of Vitamin C and Calcium but that is necessary in order to purchase the stipulated minimum amount of each nutrient.

The minimum cost per day will now be [73 × 0.21] + [28.8 × 0.27] = 15.33 + 7.776 = $23.106

Bird Corp.'s trademark was licensed to Brian Co. for royalties of 15% of the sales of the trademarked items. Royalties are payable semiannually on March 15 for sales in July through December of the prior year, and on September 15 for sales in January through June of the same year. Bird received the following royalties from Brian:

March 15 September 15

20X4 $5,000 $7,500

20X5 6,000 8,500

Brian estimated that the sales of the trademarked items would total $30,000 for July through December 20X5. In Bird's 20X5 Income Statement, the royalty revenue should be:______.

a. $13,000.

b. $14,500.

c. $19,000.

d. $20,500.

Answers

Answer:

a. $13,000

Explanation:

Calculation for what royalty revenue should be

First step is to find the estimated amount for the second half of the year

Royalties for the second half =

15%*$30,000

Royalties for the second half= $4,500

Now let Compute for the total royalty revenue

Total royalty revenue for 20X5=$8,500+$4,500

Total royalty revenue for 20X5=$13,000

Therefore the royalty revenue should be $13,000

In its first year of business, Borden Corporation had sales of $2,020,000 and cost of goods sold of $1,210,000. Borden expects returns in the following year to equal 6% of sales. The adjusting entry or entries to record the expected sales returns is (are):

Answers

Answer: Please see answers in explanation column

Explanation:

Accounts title and explanation Debit Credit

Sales returns and allowances $121,200

Sales refund payable $121,200

Calculation

Expected Sales returns and allowances = sales x expected percentage

= 2,020,000 x 6%= $121,200

Accounts title and explanation Debit Credit

Inventory returns estimated $72,600

Cost of goods sold $72,600

Calculation

expected Cost of goods sold = Cost of goods soldx expected percentage

= 1,210,000 x6%=$72,600

You pay your neighbor $100 in exchange for the used washing machine she is selling. Your neighbor puts that $100 into her pocket and takes her family out to the movies and a nice dinner at the end of the week. She still has $20 left after this outing and decides to put the remaining $20 into her savings account. This is an example of:

Answers

Answer:savings

Explanation:saves the rest of the money where she can reuse it

Question 5

1 pts

The optimal level of inflation is not zero

True

False

Answers

Bro this carácter restrictions is annoying

The transactions listed below are typical of those involving Amalgamated Textiles and American Fashions. Amalgamated is a wholesale merchandiser and American Fashions is a retail merchandiser. Assume all sales of merchandise from Amalgamated to American Fashions are made with terms n/60, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended December 31.

Amalgamated sold merchandise to American Fashions at a selling price of $230,000. The merchandise had cost Amalgamated $175,000. Two days later, American Fashions returned goods that had been sold to the company at a price of $20,000 and complained to Amalgamated that some of the remaining merchandise differed from what American Fashions had ordered. Amalgamated agreed to give an allowance of $5,000 to American Fashions. The goods returned by American Fashions had cost Amalgamated $15,270. Just three days later, American Fashions paid Amalgamated, which settled all amounts owed.

Required:

a. Indicate the effect (direction and amount) of each transaction on the Inventory balance of Readers' Corner.

b. Prepare the journal entries that Readers’ Corner would record and show any computations.

Answers

Answer:

Transaction Sales Sales Sales Net Cost of Gross

Revenues returns allowances sales goods sold profit

a. $230,000 230,000 175,000 55,000

b. 20,000 5,000 -25,000 15,270 9,730

c. - - - - - No effect

S/n General Journal Debit$ Credit$

a(1) Accounts receivable 230,000

Sales revenues 230,000

(Sales on account to American Fashions)

a(2) Cost of goods sold 175,000

Inventory 175,000

(Recorded cost of goods sold)

b(1) Sales allowances and returns 25,000

(20000+5000)

Accounts receivable 25,000

(Sales allowances and returns granted)

b(2) Inventory 15,270

Cost of goods sold 15,270

(Cost of goods sold on goods returned)

c Cash 205,000

(230,000-25,000)

Accounts receivable 205,000

Yesterday, Casey received a cable company ad for bundled TV, telephone, and Internet service that cost appreciably more than what she is currently paying. At the same time, she received a notice from her utility company that summer rates would be increasing. Her schoolbooks are costing almost twice what they cost last year, and yesterday, gasoline cost her 30 cents more per gallon than it did last week. As she ponders the situation, she can't help but wonder how prices could be rising when so many people have lost their jobs and are cutting back on expenditures. She is certain that this situation characterizes her economics professor's description of stagflation.

a. True

b. False

Answers

Answer:

a. True

Explanation:

It is true that her situation characterizes what her economics professor's mentioned on stagflation.

She experienced high internet cost more than she is paying, she was also notified on an increase in the utility summer rates, increase in the cost of her schoolbooks, and gasoline all point to what stagflation is.

Stagflation is detected when a nation experiences slow economic growth obvious with an increase in the cost of goods, which means a reduction in purchasing power as Casey experienced. When companies want to still be running their business, they will increase the cost of their services as there are fewer goods available and the currency weakened.

Linder Corporation invested $70,000 cash in marketable securities on September 1. On September 7 the company sold $10,000 of these investments for $15,000. On September 28 Linder sold $6,000 of the securities for $4,000.

Required:

a. Record the purchase of marketable securities on September 1.

b. Record the sale of marketable securities on September 7.

c. Record the additional sale of marketable securities on September 28.

d. Record the necessary month end fair value adjustment on September 30. The market price for Linder Corporation's remaining unsold securities was $58,000.

Answers

Answer and Explanation:

Find attached

The December 31, 2018, adjusted trial balance for Fightin' Blue Hens Corporation is presented below.

Accounts Debit Credit

Cash $12,000

Accounts Receivable 150,000

Prepaid Rent 6,000

Supplies 30,000

Equipment 400,000

Accumulated Depreciation $135,000

Accounts Payable 12,000

Salaries Payable 11,000

Interest Payable 5,000

Notes Payable (due in two years) 40,000

Common Stock 300,000

Retained Earnings 60,000

Service Revenue 500,000

Salaries Expense 400,000

Rent Expense 20,000

Depreciation Expense 40,000

Interest Expense 5,000

Totals $1,063,000 $1,063,000

Accounts Debit Credit

Service Revenue 500,000

Salaries Expense 400,000

Rent Expense 20,000

Depreciation Expense 40,000

Interest Expense 5,000

Total $1,063,000 $1,063,000

Required:

1. Prepare an income statement for the year ended December 31, 2021.

2. Prepare a statement of stockholders' equity for the year ended December 31, 2021, assuming no common stock was issued during 2021.

3. Prepare a classified balance sheet as of December 31, 2021.

Answers

Answer:

Please see answers below

Explanation:

1. Prepare an income statement for the year ended, December 31, 2021

Fightin' Blue Hems Corporation, Income statement for the year ended, December 31, 2021.

Details

$

Service revenue

500,000

Salaries expense

400,000)

Rent expense

20,000)

Depreciation expense

40,000)

Interest expense

5,000)

Earnings for the year

35,000

2. Prepare a statement of stockholder's equity for the year ended, 31, December, 2021

Fightin' Blue Hens Corporation statement of stockholder equity for the year ended , December 31, 2021.

Details

$

Common stock

300,000

Retained earnings

60,000

Earnings for the year

35,000

Stockholder equity

395,000

3. Prepare a classified balance sheet as at 31, December

Fightin' Blue Hens Corporation, classified balance sheet for the hear ends, December 31, 2021.

Details

$

Fixed assets

Equipment

400,000

Accumulated depreciation

135,000

Net fixed assets

265,000

Current assets

Cash

12,000

Accounts receivables

150,000

Prepaid rent

6,000

Supplies

30,000

Total current assets

198,000

Current liabilities

Accounts payable

($12,000)

Salaries payable

(11,000)

Interest payable

(5,000)

Working capital

170,000

Long term liabilities

Notes payable (due in two years)

(40,000)

Net total assets

395,000

Financed by;

Common stock

300,000

Retained earnings

60,000

Earnings for the year

35,000

Stockholder equity

395,000

Assignment 3 Suggested Length: 750 to 1000 words Ethical Theories to Apply: Golden Rule and Virtue Ethics

1. Task You work in the Ethics Department for ABC Company (ABC). Your department is dedicated to advising its employees about their ethical obligations in the corporate setting. You are an internal consultant who provides advice and most importantly, recommendations for action to employees of the firm. All communications you receive in this capacity are confidential. Luke, an employee of ABC, comes to you with the following scenario and asks for your advice. He wants to fully consider the situation. Your task is to advise and recommend a course of action based on the specified ethical lenses and facts as given. Below are the facts that Luke provides to you. ***** Luke has been asked to work on a project that involves developing land recently purchased by ABC to build an adult entertainment retail store. According to the plan, the land is located on the corner of the neighborhood where Owen, Luke’s brother, lives. Luke knows that as soon as the plans for the store are made public, property values for the surrounding neighborhood will decrease significantly. ABC plans to publicly announce the project one month from today. Luke is concerned about his obligations of confidentiality to his company. However, Luke is also very close to Owen, who recently told Luke that he received an offer to sell his house at an "okay" price given the current real estate market. Owen is considering selling but hasn’t made any final decision yet. He wonders if he might get a better offer a few years from now when the real estate market improves. What is the ethical issue, why is this an issue, and what should Luke do about it?

***** For assignment 3, prepare a memo, setting out your analysis and recommendations, that considers ONLY the following two theories: Golden Rule and Virtue Ethics.

Answers

Answer:

My answer is a little long, so you will probably need to summarize it.

The ethical issue here is that you work for a company that is about to open a store that will make the price of your brother's house to plummet. Your brother has the option to sell his house right now, but if you tell him to accept the offer, you will be breaching your employment duties.

Is your duty towards your brother more or less important than the duty towards the company?

We can analyze both possible outcomes:

You do not tell your brother and he does not sell his house. After the store is announced, your brother's house will decrease in value. That means that your brother will lose a lot of money, but you complied with the obligation of confidentiality that you have with your company. The downside is that once your brother knows about it, he will hate you for the rest of his life. And the hatred will probably not be limited to only your brother, most, if not all of your family will be very unpleased and terribly mad at you. Your family will probably wonder why your parents didn't abort you?, or are you adopted?, or do you simply hate humanity? On the other hand, you decide that you value your brother and whole family, and you decide to tell him to accept the offer. You will have breached your confidentiality obligation towards the company, but you will have literally saved your brother's financial situation, and you will have saved any type of relationship that you have with your family. Will the company be hurt by your decision? No, it will not make any difference to them. They are announcing the decision in just a few days, so anything that you tell your brother will not make any difference. Since your brother will try to sell his house, he will keep the information to himself, since telling other people will only ruin any possible sale.If we follow the golden rule: do to others what you would like them to do to you, then obviously we should tell Owen about our company's plans. If we were Owen, that information would be really important for us.

If we follow virtue ethics, then it gets a little bit more complicated. Is telling Owen about the new store a virtuous action? Would a virtuous person do it? To be honest, I'm not really sure what exactly is a virtuous person.

What I understand is that virtue ethics is based on who you are, and not what you really will do. So, the question here would be: Are you a good (or virtuous) brother? Are you a good (or virtuous) employee? In this case, you cannot be a virtuous employee and a virtuous brother at the same time, so it depends on which you value the most. Going back to the possible outcomes, I would prefer to be a virtuous brother in this case.

Nanjones Company manufactures a line of products distributed nationally through wholesalers. Presented below are planned manufacturing data for the year and actual data for November of the current year. The company applies overhead based on planned machine hours using a predetermined annual rate.

Planning Data

Annual November

Fixed manufacturing overhead $1,200,000 $100,000

Variable manufacturing overhead 2,400,000 220,000

Direct labor hours 48,000 4,000

Machine hours 240,000 20,000

Data for November

Direct labor hours (actual) 4,200

Direct labor hours (plan based on output) 4,000

Machine hours (actual) 21,600

Machine hours (plan based on output) 21,000

Fixed manufacturing overhead $101,200

Variable manufacturing overhead $214,000

The fixed overhead volume variance for November was

a. $1,200 unfavorable.

b. $5,000 favorable.

c. $5,000 unfavorable.

d. $10,000 favorable.

Answers

Answer:

Manufacturing overhead volume variance= $1,200 unfavorable

Explanation:

First, we need to calculate the predetermined overhead rate:

Predetermined manufacturing overhead rate= total estimated overhead costs for the period/ total amount of allocation base

Fixed Predetermined manufacturing overhead rate= 1,200,000/240,000

Fixed Predetermined manufacturing overhead rate= $5 per machine hour

Now, to calculate the fixed manufacturing overhead volume variance, we need to use the following formula:

Manufacturing overhead volume variance = Actual Factory Overhead - Budgeted Allowance Based on Standard Hours

Manufacturing overhead volume variance= (101,200) - (5*20,000)

Manufacturing overhead volume variance= $1,200 unfavorable

Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc and Michelle also paid $2,500 of qualifying moving expenses, and Marc paid alimony to a prior spouse in the amount of $1,500. Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire year. Thus, Marc and Michelle are allowed to claim a $1,000 child tax credit for Matthew. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions and they had a total of $5,500 in federal income taxes withheld from their paychecks during the course of the year.

a) What is Marc and Michelle’s gross income?

b) What is Marc and Michelle’s adjusted gross income?

c) What is the total amount of Marc and Michelle’s deductions from AGI?

d) What is Marc and Michelle’s taxable income?

e) What is Marc and Michelle’s taxes payable or refund due for the year? (Use the tax rate schedules.)

f) Complete the first two pages of Marc and Michelle’s Form 1040 (use 2015 forms if 2016 forms are unavailable).

Answers

Answer:

A) $76500

B) $72500

C) $24750

D) tax refund of $260

Explanation:

A) calculate Marc and Michelle's gross income

Marc salary = $64000

Michelle's salary = $12000

interest from corporate bond = $ 500

Hence gross income = 64000 + 12000 + 500 = $76500

B) Calculate Marc and Michelle's Adjusted gross income

Gross income = $76500

qualifying moving expenditure = $2500

Alimony paid to previous spouse = $1500

adjusted gross income = 76500 - 2500 - 1500 = $72500

C) Calculate the total amount of Marc and Michelle's deductions from AGI

Standard deduction = $12600

itemized deduction = $6000

personal and dependency allowance = $12150

To calculate the Deductions from AGI we have to add the personal and dependency allowance to the standard deduction ( higher value between standard deduction and itemized deduction )

= 12600 + 12150 = $24750

D ) calculate Marc and Michelle's taxable income

Adjusted gross income = $72500

deduction from itemized deduction = $24750

taxable income = 72500 - 24750 = $47750

E) Determine if Marc and Michelle's taxes payable or refund due for the year

Tax rate schedules :

between $18451 to $79000 : tax rate = $1845 + 15% of income over $18450

Taxable income = $47750

Tax liability = 1845 + (47750 - 18450) * 15% = $6240

child tax credit = $1000

prepayment of taxes = $5500

Tax refund = tax liability - child tax - prepayment of taxes

6240 - 1000 - 5500 = $260

hence there will be a tax return of $260

So you want to finance a car for $4,840. Let’s say we offer you a 4.5% interest rate on a 2-year loan and 6% on a 5-year loan. Enter this info into the calculator to see your monthly and total cost by loan term.

Financing Amount

$4840

Correct

Interest Rate on 2-Year Loan

Interest Rate on 5-Year Loan

Answers

Answer:

Interest Rate on 2-Year Loan...$435.6

Interest Rate on 5-Year Loan...$1,452

Explanation:

The formula for calculating simple interest is as follows.

I = P x R x T,

where I = interest

P= Principal

R= interest rate

T= time

For the loan at 4.5 percent for 2 years, the interest will be

= $4,840 x 4.5/100 x 2

= $4,840 x 0.045 x 2

= $435.6

Total cost of the loan will principal plus interest

=$435.6 + $4,840

=$5,275.6

Monthly loan cost

= $5,275.6/24

=$219.81

Total loan cost..$5,275.6

Monthly loan cost ...$219.81

For the Loan at 6 percent for 5 years, the interest will be

= $4,840 x 6/100 x 5

= $4,840 x 0.06 x 5

=$1,452

Total cost of the loan will be principal plus interest

=$ 4,840 + $1,452

=$6,292

Monthly costs will be

=$6,292/60

=$104.87

Total loan cost... $6,292

Monthly loan costs... $104.87

Which franchise model do automobile dealerships usually follow?

Answers

Answer:

hope it helps..

Explanation:

Automakers sold vehicles through department stores, by mail order and through the efforts of traveling sales representatives. The prevailing delivery system was direct-to-consumer sales.

Company Owned Company Operated franchise model do automobile dealerships usually follow. These are companies that have been granted a franchise to purchase and resell cars made by particular manufacturers. They are typically found on sites with enough space to accommodate an automobile showroom as well as a small garage for upkeep and repairs.

What is the difference between a franchise and a dealership?A licensed dealer functions much like a retail distributor. Dealers have more freedom when it comes to the layout of their stores and the products they offer, while franchisees are subject to a set of corporate regulations. The majority of the time, a dealer will sell the same goods and have the parent company's name and logo.

The business model for franchises. You can run a business if you buy a franchise as an investor or franchisee. You receive a format or system created by the business (franchisor), the right to use its name for a predetermined period of time, and assistance in exchange for paying a franchise fee.

Learn more about franchises here:

https://brainly.com/question/29376853

#SPJ2

Consider a simple example economy where there are two goods, coconuts and restaurant meals (coconut-based). There are two firms. A coconut producer collects and sells 10 million coconuts at $2.00 each. The firm pays $5 million in wages, $0.5 million in interest on an old loan, and $1.5 million in taxes to the government. We also know that 4 million coconuts are sold to the public for consumption, and 6 million coconuts are sold to the restaurant firm, which uses them to prepare meals. The restaurant sells $30 million in meals. The restaurant pays $4 million in wages and the government $3 million in taxes. The government supplies security and accounting services and employs only labor, and government workers are paid $5.5 million, collected in taxed by the government. Finally, consumers pay $1 million in taxes to the government in addition to the taxes paid by the two firms.

Required:

a. Compute GDP for this simple economy using the product approach.

b. Compute GDP for this simple economy using the expenditure approach.

c. Compute GDP for this simple economy using the income approach.

d. Now, suppose that the coconut producer cannot sell 1 million coconuts during the course of the year. These are collected coconuts that are not sold to the public (assume that sales to the other firm, the restaurant, remain the same).

e. How does this new piece of information affect your calculations in the expenditure approach? Explain.

Answers

A) Product Approach

GDP = Value added of all industries

Value added = revenue - intermediate costs

Value added coconut producer = $20,000,000 (it does not have intermediate costs)

Value added restaurant = $30,000,000 - $12,000,000 (cost of coconuts)

= $18,000,000

Value added government = $5,500,000 (collected in taxes, $3 million from the restaurant, $1.5 million from the coconut producer, and $1 million from consumers).

GDP = $20,000,000 + $18,000,000 + $5,500,000

= $43,000,000

B) Expenditure Approach

GDP = Consumption + Investment + Government Spending + Net Exports

Consumption = $8,000,000 in coconuts + $30,000,000 in meals

= $38,000,000

Investment = $0

Government Spending = $5,500,000 in government wages

Net Exports = $0 (it is a closed-economy)

GDP = $38,000,000 + $0 + $5,500,000 + $0

= $43,500,000

C) Income Approach

Wages = $14,500,000

Corporate Profits = $24,000,000

Interest income = $500,000

Taxes = $4,500,000

GDP = $43,500,000

e. How does this new piece of information affect your calculations in the expenditure approach? Explain.

GDP under the expenditure approach, would rise by the value of the unsold coconuts ($1 million) as long as the coconuts were harvested in the given year. This is because inventory produced in the given year, is part of that year's GDP.

Many assets provide a series of cash inflows over time; and many obligations require a series of payments. When the payments are equal and are made at fixed intervals, the series is an annuity. There are three types of annuities: (1) __________ (2)_________, and (3) __________-. One can find an annuity's future and present values, the interest rate built into annuity contracts, and the length of time it takes to reach a financial goal using an annuity.

Answers

Answer:

Fixed annuities

Variable annuities

Indexed annuities

Explanation:

Annuities are defined as contract that pays out regular amounts over time at a particular interest rate.

Usually there is an initial investment of a lumps sum or a series of deposits.

Annuities are classified based on level of risk and payout potential into 3:

- Fixed annuity give out a fixed guaranteed payout amount. The risk is low but the payout is low. Slightly above certificate of deposits.

- Variable annuity is one that gives room for a higher payout but risk is also higher. A set of mutual funds are invested in and payout is dependent on how they perform.

- Indexed annuity gives higher return that is tied to the performance of an index like the S&P 500. The risk is lower than that of variable annuity

Federated Fabrications leased a tooling machine on January 1, 2021, for a three-year period ending December 31, 2023. The lease agreement specified annual payments of $48,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2022. The company had the option to purchase the machine on December 30, 2023, for $57,000 when its fair value was expected to be $72,000, a sufficient difference that exercise seems reasonably certain. The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor’s implicit rate of return was 10%.

Required:

a. Calculate the amount Federated should record as a right-of-use asset and lease liability for this finance lease.

b. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term.

c. Prepare the appropriate entries for Federated from the beginning of the lease through the end of the lease term.

Answers

Answer:

All requirements solved

Explanation:

we can calculate the right of use asset and lease liability by determining the present value of all future cash flows and after calculating present values sum them up

Requirement 1: Right of use asset and lease liability

Present value (year 0) = 48,000 / (1+10%)^0 = 48,000

Present value (year 1) = 48,000 x 1/(1+10%)^1

Present value (year 1) = 48,000 x 0.909 = 43,636

Present value (year 2) = 48,000 x 1/(1+10%)^2

Present value (year 2) = 48,000 x 0.826 = 39,670

Present value (year 3) = 57,000 x 1/(1+10%)^3

Present value (year 3) = 57,000 x 0.751 = 42,825

Total present value = 48,000 + 43,636 + 39,670 + 42,825

Total present value = 174,131

Right of use asset and lease liability = 174,131

Requirement 2: Amortization schedule

Date payments effective interest Decrease Outstanding

10% in balance balance

1/1/21 174,131

1/1/21 48,000 48,000 126,131

12/31/21 48,000 12,613 35,387 90,744

12/31/22 48,000 9.074 38,926 51,818

12/31/23 48,000 5,182 51,818

Requirement 3: Journal entries

Amortization expense = 174,131/6

Amortization expense = 29,022

1/1/21

Dr Righ of use 74,131

Cr Lease payable 74,131

1/1/21

Dr lease payable 48,000

Cr cash 48,000

12/31/21

Dr Lease payable 35,387

Dr Interest expense 12,613

Cr Cash 48,000

12/31/21

Dr Amortization expense 29,022

Cr Right of use 29,022

12/31/22

Dr Lease payable 38,926

Dr Interest expense 9,074

Cr Cash 48,000

12/31/22

Dr Amortization expense 29,022

Cr Right of use 29,022

12/31/23

Dr Lease payable 51,818

Dr Interest expense 5,182

Cr Cash 57,000

12/31/23

Dr Amortization expense 29,022

Cr Right of use 29,022

Susie buys a share of Alphabet stock through her broker, Mr. Diaz, who works for Acme Investing and purchases the stock at the New York Stock Exchange. In this transaction, __________ is a financial instrument, __________ is a financial institution, and __________ represents a financial market.

Answers

Answer:

Alphabet stock; Acme Investing; New York Stock Exchange.

Explanation:

Susie buys a share of Alphabet stock through her broker, Mr. Diaz, who works for Acme Investing and purchases the stock at the New York Stock Exchange. In this transaction, Alphabet stock is a financial instrument, Acme Investing is a financial institution, and New York Stock Exchange represents a financial market.

Financial instruments can be defined as assets which are having monetary value or used to record a monetary transaction. Financial instruments are generally classified on the basis of their risks, maturity, issuers etc. Some examples of financial instruments are stocks, treasury bills, commercial paper, money market mutual fund, certificate of deposits, corporate bonds etc. The market where these financial instruments (securities and derivatives) are being traded at a low transaction rate is referred to as the financial market.

Furthermore, financial institutions can be defined as a business firm or company that is involved in the business of trading financial instruments.

Martinez Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets.

Projected Benefit Obligation Plan Assets Value

2019 $2,340,000 $2,223,000

2020 2,808,000 2,925,000

2021 3,451,500 3,042,000

2022 4,212,000 3,510,000

The average remaining service life per employee in 2019 and 2020 is 10 years and in 2021 and 2022 is 12 years. The net gain or loss that occurred during each year is as follows:

2019, $327,600 loss; 2020, $105,300 loss; 2021, $12,870 loss; and 2022, $29,250 gain. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.)

Required:

Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four years, setting up an appropriate schedule.

Year Minimum Amortization of Loss

2013 $

2014 $

2015 $

2016 $

Answers

Answer:

2020 $11,700

2021 $8,080

2022 $14,040

Explanation:

PBO = Projected benefit Obligation

PA = Plan Asset

Acc. OCI = Accumulated OCI Gain / Loss

Min. Amort loss = Minimum Amortization of Loss

Year : PBO ; PA ; Corridor 10% ; Acc. OCI ; Min. Amort loss

2019 : $2,340,000 ; $2,223,000 ; $234,000

2020 : $2,808,000 ; $2,925,000 ; $280,800 ; $397,800 ; 11,700

2021 : $3,451,500 ; $3,042,000 ; $345,150 ; $264,350 ; 8,080

2022 : $4,212,000 ; $3,510,000 ; $421,200 ; $280,800 ; 14,040

The following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2021:

Penske Stanza

Revenues $(842,000 ) $(568,000 )

Cost of goods sold 299,700 142,000

Depreciation expense 207,000 304,000

Investment income Not given 0

Dividends declared 80,000 60,000

Retained earnings, 1/1/21 (668,000 ) (222,000 )

Current assets 572,000 566,000

Copyrights 1,076,000 449,500

Royalty agreements 604,000 1,180,000

Investment in Stanza Not given 0

Liabilities (546,000 ) (1,631,500 )

Common stock (600,000 )($20 par) (200,000 ) ($10 par)

Additional paid-in capital 150,000 80,000

On January 1, 2013, Penske acquired all of Stanza's outstanding stock for $680,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition copyrights (with a six-year remaining life) have a $440,000 book value but a fair value of $560,000.

a. As of December 31,2013, what is the consolidated copyrights balance?

b. For the year ending December 31,2013, what is consolidated net income?

c. As of December 31,2013, what is the consolidated retained earnings balance?

d. As of December 31,2013, what is the consolidated balance to be reported for goodwill?

Answers

Answer:

a. $1,625,500

b. $437,300

c. $1,025,300

d. $58,000

Explanation:

a. As of 31, December 2013, what is the consolidated copy rights balance

b. For the year ending, December 31, 2013, what is consolidated net income

c. As of December 31, 2013, what is the consolidates retained earnings balance

d. As of December 31, 2013 what is the consolidated balance to be reported for Goodwill.

Please find attached detailed explanations to the above questions and answers.

Question 5 of 10

Why do business often add fees to their invoices?

O A. To help pay for business expenses

B. To attract new customers

C. To reward customers' for their loyalty

D. To make more profit than their competitors

Answers

Answer: I think it's A

Explanation:

Answer:

Its A!

Explanation:

Just took the quiz

Presented below is information from Headland Computers Incorporated.

July 1 Sold $22,600 of computers to Robertson Company with terms 3/15, n/60. Headland uses the gross method to record cash discounts. Headland estimates allowances of $1,334 will be honored on these sales.

10 Headland received payment from Robertson for the full amount owed from the July transactions.

17 Sold $256,100 in computers and peripherals to The Clark Store with terms of 2/10, n/30.

30 The Clark Store paid Headland for its purchase of July 17.

Answers

Omitted question-- Prepare the necessary journal entries for Headland computers

Answer: Please see answers below

Explanation:

Journal to record sales revenue

Date Account and explanation Debit Credit

July 1st Account receivables $22,600

Sales Revenue $22,600

Journal to record allowances for sales returns

July 1st Sales returns and allowances $1,334

Allowances for sales return and allowances $1,334

Journal to record receipt of cash from Robertson within discount period

July 10 Cash $21,922

Sales discount $678

Account receivables $22,600

Calculation

Discount = 22,600 x 3%= $678

Cash = $22,600 - $678= $21,922

Journal to record sales revenue

July 1`7 Account receivables $256,100

Sales revenue $256,100

Journal to record receipt of cash from Clark within discount period

July 30 Cash $250,978

Sales discount $5,122

Account receivables $256,100

Calculation

Discount = 256,100 x 2%= $5,122

Cash = $256,100 -$5,122= $250,978

You are preparing the financial statements for the Johnson family. To begin with you just want to identify each line and indicate where it will be going (e.g. Balance Sheet, Income Statement). Just write Balance Sheet and or Income statement next to each line.

Home Value $549,000

Joint Savings balance $5,400

Tom's 2014 Salary Before Taxes was $78,000

Kate's 2014 Salary Before Taxes was $84,000

Fed income taxes, state income taxes and FICA combined totaled $46,120 (paid)

2014 property taxes were $14,000 (paid)

Mortgage $300,000

House Payment plus insurance per month $2400

Kate bought Microsoft stock in 2012 and they still own it. It's worth $40,0000

Tom's 401k at work has several mutual funds worth a total of $120,000

Tom has a 2002 VW GTI worth about $3,000

Kate has a 2013 Audi S6 worth about $35,000

Car loan on Audi totals is $25,000

Car Payment is $1583

Car insurance for 2014 was $2000 (paid)

Credit Card Balance $4,000

Tom's monthly contribution o his 401k is $1,000

Joint Checing account balance $1,200

Answers

Answer:

Home Value $549,000 - Balance Sheet

Joint Savings balance $5,400 - Balance Sheet

Tom's 2014 Salary Before Taxes was $78,000 - Income Statement

Kate's 2014 Salary Before Taxes was $84,000 - Income Statement

Fed income taxes, state income taxes and FICA combined totaled $46,120 (paid) - Income Statement

2014 property taxes were $14,000 (paid) - Income Statement

Mortgage $300,000 - Balance Sheet

House Payment plus insurance per month $2400 - Income Statement

Kate bought Microsoft stock in 2012 and they still own it. It's worth $40,0000 - Balance Sheet

Tom's 401k at work has several mutual funds worth a total of $120,000 - Balance Sheet

Tom has a 2002 VW GTI worth about $3,000 - Balance Sheet

Kate has a 2013 Audi S6 worth about $35,000 - Balance Sheet

Car loan on Audi totals is $25,000 - Balance Sheet

Car Payment is $1583 - Income Statement

Car insurance for 2014 was $2000 (paid) - Income Statement

Credit Card Balance $4,000 - Balance Sheet

Tom's monthly contribution o his 401k is $1,000 - Income Statement

Joint Checing account balance $1,200 - Balance Sheet

In 2021, Ryan Management collected rent revenue for 2022 tenant occupancy. For financial reporting, the rent is recorded as deferred revenue and then recognized as revenue in the period tenants occupy rental property. For tax reporting, the rent is taxed when collected in 2021. The deferred portion of the rent collected in 2021 was $194.0 million. No temporary differences existed at the beginning of the year, and the tax rate is 25%. Suppose the deferred portion of the rent collected was $76 million at the end of 2022. Taxable income is $760 million. Prepare the appropriate journal entry to record income taxes Iin 2022.

Transaction General Journal Debit Credit

Income tax expense

Deferred tax asset

Income taxes payable 340.0

Answers

Answer:

Ryan Management

Journal Entries

Date Particulars Debit'million Credit'million

31-Dec-22 Income tax expense $219.50

To Income tax payable $190

($760 * 25%)

To Deferred tax asset $29.50

[($194 - $76)*25%]

(To record income tax expense and reversal of Deferred

tax asset)

Kim Co. purchased goods with a list price of $175,000, subject to trade discounts of 20% and 10%, with no cash discounts allowable. How much should Kim Co. record as the cost of these goods

Answers

Answer:

the cost of these goods is $126,000

Explanation:

The computation of the cost of these goods is shown below:

= List price × (1 - first discount rate) × (1 - second discount rate)

= $175,000 × (1 - 0.20) × (1 - 0.10)

= $126,000

Hence, the cost of these goods is $126,000

We simply applied the above formula so that the correct amount could come

The same is to be relevant

The cost of goods sold is the value of goods at which they are made available to the customers at an affordable price. The costs are the particular term used for the product's value to specify that the goods and services when availed to the customers carries a value or the price.

The computation of the cost of these goods is shown below:

[tex]\begin{aligned}\text{Cost of Goods}&= \text{list price} \times (1 - \text{first discount rate}) \times (1 - \text{second discount rate})\\&=\$175,000 \times (1 - 0.20)\times(1 - 0.10)\\& = \$126,000\end{aligned}[/tex]

Hence, the cost of these goods is $126,000

To know more about the calculation of the cost of goods, refer to the link below:

https://brainly.com/question/19151327

If overhead is applied using traditional costing based on direct labor hours, the overhead application rate is:

Answers

Answer:

Predetermined manufacturing overhead rate= total estimated overhead costs for the period/ total amount of allocation base

Explanation:

If overhead is applied using traditional costing based on direct labor hours, the overhead application rate is:

Predetermined manufacturing overhead rate= total estimated overhead costs for the period/ total amount of allocation base

For example:

Total estimated overhead= $150,000

Allocation base= direct labor hours

Estimated Total number of direct labor hours= 10,000

Predetermined manufacturing overhead rate= 150,000/10,000

Predetermined manufacturing overhead rate= $15 per direct labor hour

In 2013, Space Technology Company modified its model Z2 satellite to incorporate a new communication device. The company made the following expenditures:

Basic research to develop the technology $ 2,000,000

Engineering design work 680,000

Development of a prototype device 300,000

Acquisition of equipment 60,000

Testing and modification of the prototype 200,000

Legal and other fees for patent application on the new

communication system 40,000

Legal fees for successful defense of the new patent 20,000

Total $ 3,300,000

The equipment will be used on this and other research projects. Depreciation on the equipment for 2013 is $10,000.

During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all of the above as costs of the patent. Management contends that the device simply represents an improvement of the existing communication system of the satellite and, therefore, should be capitalized.

Required:

Prepare correcting entries that reflect the appropriate treatment of the expenditures.

1. Record the correcting entry to expense R&D costs incorrectly capitalized

2. Record the correcting entry to capitalize the cost of equipment incorrectly capitalized as a patent.

3. Record the correcting entry to record depreciation on equipment used in R&D projects.

Answers

Answer:

1. Dec 31

Dr Research and Development Expense $3,180,000

Cr 2013 Patent $3,180,000

2. Dec 31

Dr Equipment $60,000

Cr 2013 Patent $60,000

3. Dec 31

Dr Research and Development Expense $10,000

Cr 2013 Accumulated Depreciation - Equipment $10,000

Explanation:

1. Preparation of the Journal entry to Record the correcting entry to expense

Dec 31

Dr Research and Development Expense $3,180,000

Cr 2013 Patent $3,180,000

(Being To record research and development expense )

Calculation for the Total amount of theresearch and development expense

Basic research to develop the technology $2,000,000

Engineering design work $680,000

Development of a prototype device $300,000

Testing and modification of the prototype $200,000

TOTAL research and development expense $3,180,000

2. Preparation of the journal entry to Record the correcting entry to capitalize the cost of equipment

Dec 31

Dr Equipment $60,000

Cr 2013 Patent $60,000

(Being To correct cost of equipment capitalized to patent)

3. Preparation of the Journal entry to Record the correcting entry to record depreciation on equipment

Dec 31

Dr Research and Development Expense $10,000

Cr 2013 Accumulated Depreciation - Equipment $10,000

(Being To record research and development expens

a. On December 31, Gina receives a distribution of $140,000 cash in liquidation of her partnership interest. Nothing is stated in the partnership agreement about goodwill. Gina's outside basis for the partnership interest immediately before the distribution is $90,000. (1) How much is Gina's recognized gain from the distribution

Answers

Answer:

some information is missing in this question:

the fair market value of Gina's interest int he partnership = $480,000 x 25% = $120,000

Gina is receiving $140,000 in cash, therefore, $20,000 can be considered goodwill.

Since Gina's outside basis is $90,000 (= $75,000 of cash + $15,000 of capital assets), she cannot claim any capital gain, instead she must declare an ordinary gain from the distribution (ordinary income) = $140,000 - $90,000 = $50,000.

The partnership can deduct Gina's gain ($50,000) since no part of it included property payment.

FlanCrest Enterprises is a mid-sized auto supply company that manufactures electronic components for cars. It has approximately 200 employees, with about 150 working on the production line. Its primary customer is Widespread Motors, a large international auto manufacturer. Widespread Motors primarily sells their cars based on price, aiming to make the prices as low as possible in any particular market segment. The cars may not have as many features, but still operate and cost less than those of their competitors. FlanCrest, under the direction of Widespread, has been asked to reduce the price of its electronic components for the next order due to competitive pressure in the market for Widespread's best-selling car. To cut its prices and keep its biggest customer, FlanCrest announces that they will be eliminating the popular community college tuition reimbursement program and eliminating all overtime for production workers.

Which of the below choices most accurately describes the new HR strategy at FlanCrest Enterprises?

a. Commitment, because they are demonstrating commitment to the development of their workforce

b. Control, because they are attempting to control employees within the workplace

c. Commitment, because they are demonstrating commitment to their key customers

d. Control, because they are attempting to minimize labor costs

Answers

Answer:

c. Commitment, because they are demonstrating commitment to their key customers

Explanation:

In the given scenario FlanCrest specialise in selling electronic components for cars. Their main customer is Widespread Motors who are known for primarily sells their cars based on price, aiming to make the prices as low as possible in any particular market segment.

Based on this mode of doing business by their client FlanCrest have decided to cut its prices and keep its biggest customer, FlanCrest announces that they will be eliminating the popular community college tuition reimbursement program and eliminating all overtime for production workers.

This action was taken as a way to keep its key customer based on their business needs

Theresa works as a Risk Management Specialist for an investment corporation. Which best describes her educational pathway?

A. an associate’s degree, then a bachelor’s degree

B. a master’s degree, then vocational school

C. vocational school, then an associate’s degree

D. a bachelor’s degree, then a master’s degree

Answers

Answer:

The answer is b

Explanation:

i'm doing the unit test right now

Answer:

I feel that the correct answers is D because to become a Risk Management Specialist you must have a bachelors in business and most likely a master.

Explanation: