The following transactions relate to the General Fund of the City of Buffalo Falls for the year ended December 31, 2020:

a. Beginning balances were: Cash, $98,000; Taxes Receivable, $197,000; Accounts Payable, $56,000; and Fund Balance, $239,000.

b. The budget was passed. Estimated revenues amounted to $1,280,000 and appropriations totaled $1,276,400. All expenditures are classified as General Government.

c. Property taxes were levied in the amount of $940,000. All of the taxes are expected to be collected before February 2021.

d. Cash receipts totaled $910,000 for property taxes and $310,000 from other revenue.

e. Contracts were issued for contracted services in the amount of $104,000.

f. Contracted services were performed relating to $93,000 of the contracts with invoices amounting to $90,400.

g. Other expenditures amounted to $986,000.

h. Accounts payable were paid in the amount of $1,130,000.

i. The books were closed.

Required:

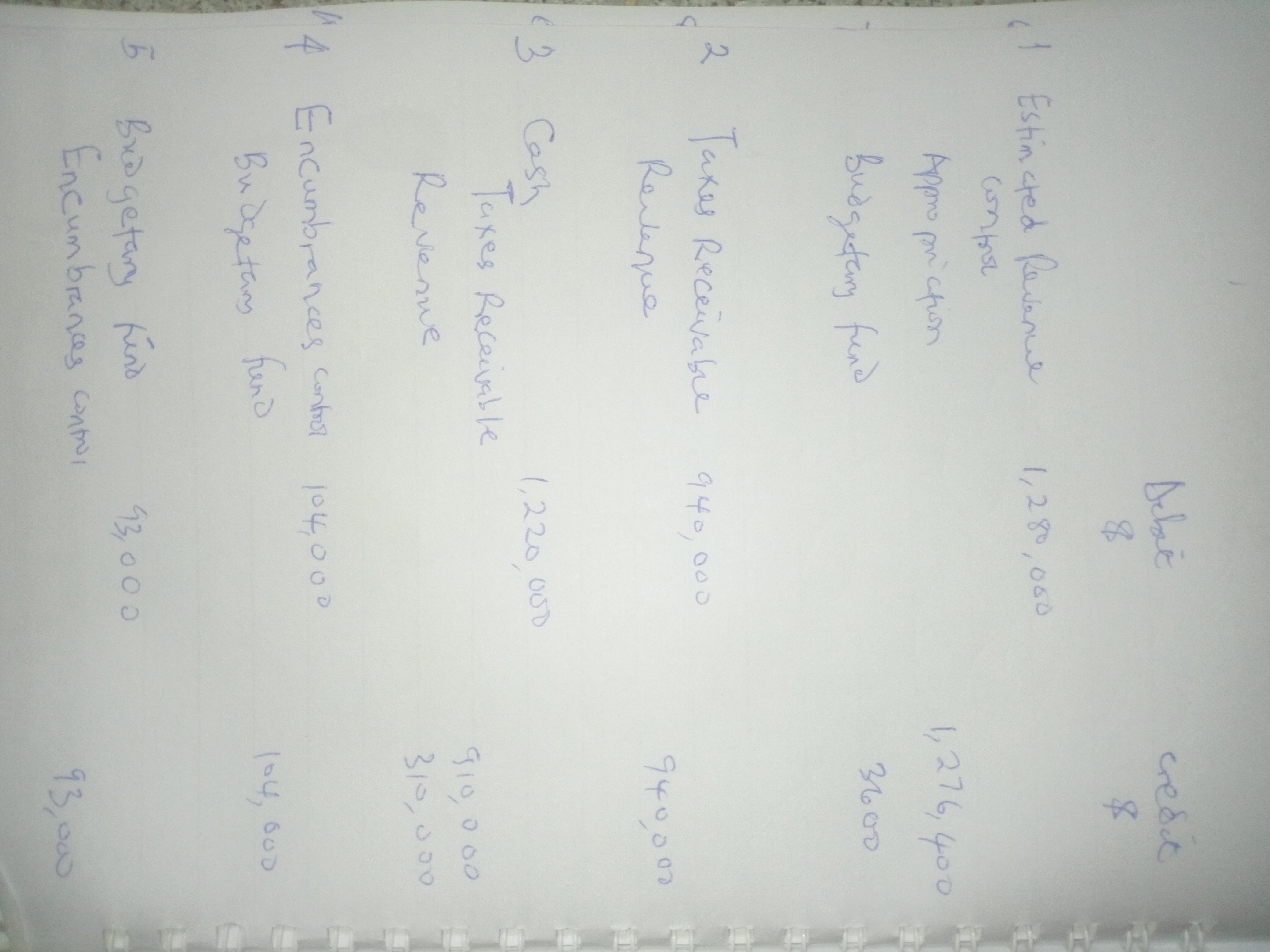

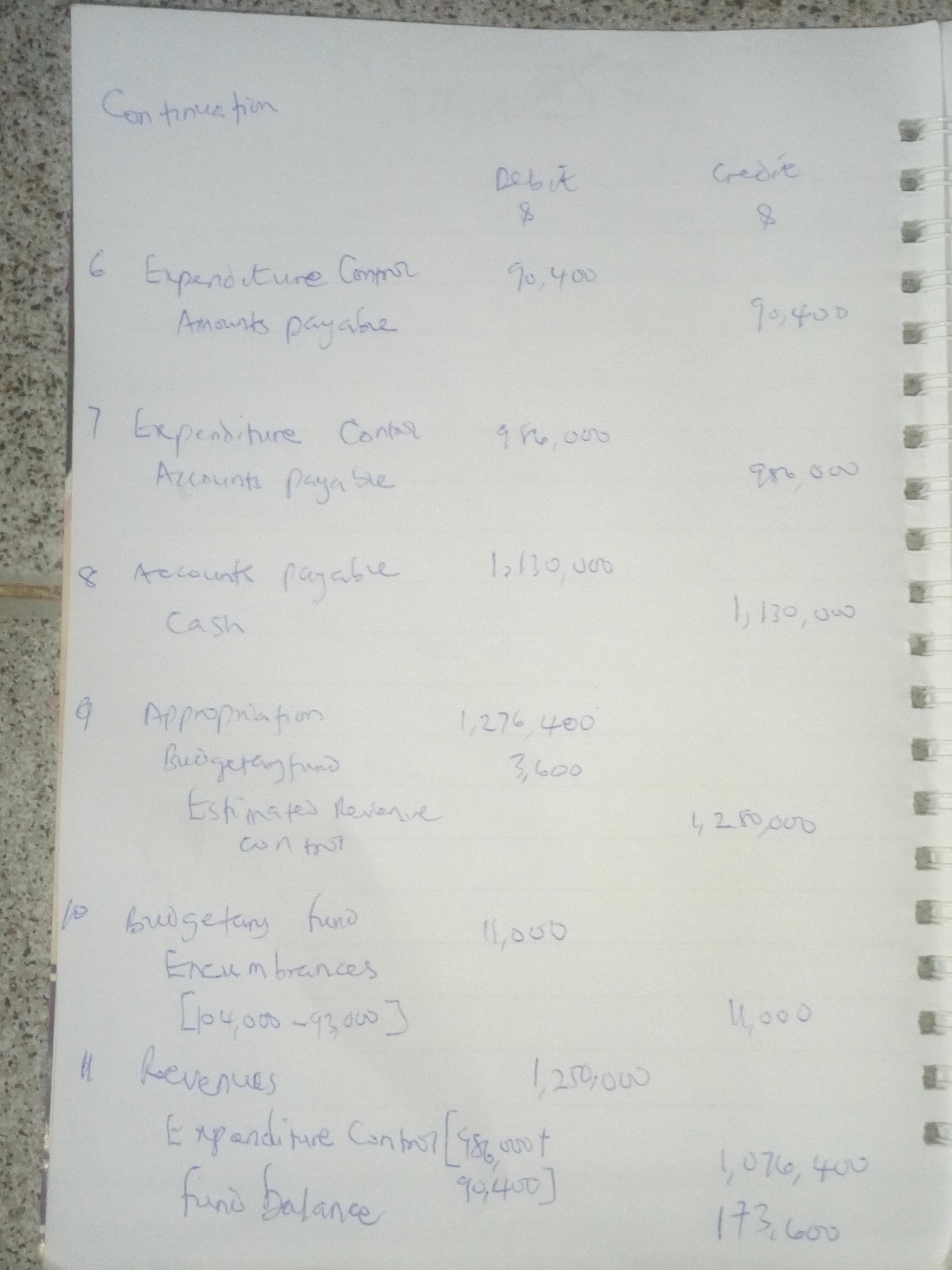

a. Prepare journal entries for the above transactions.

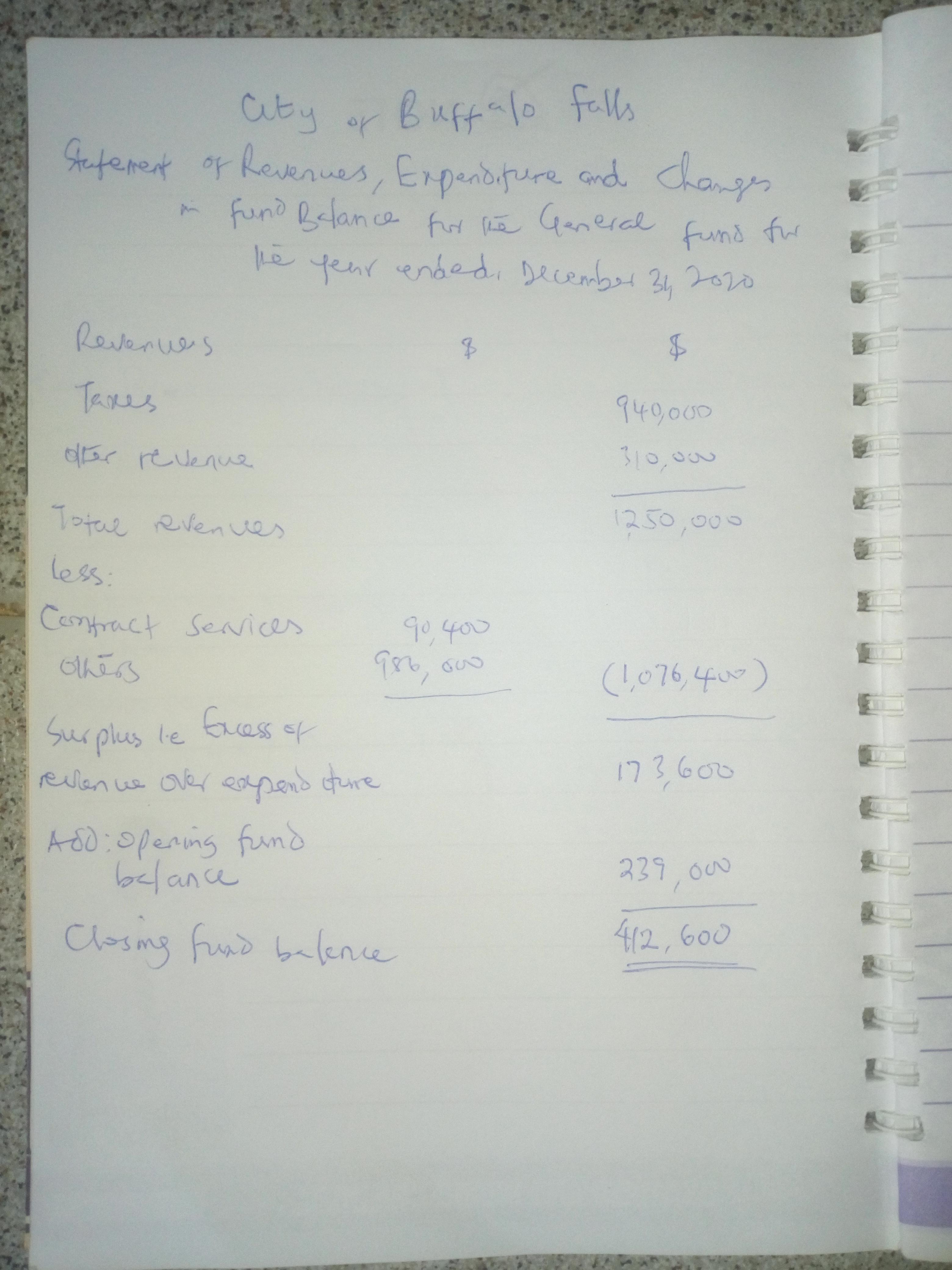

b. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balance for the General Fund.

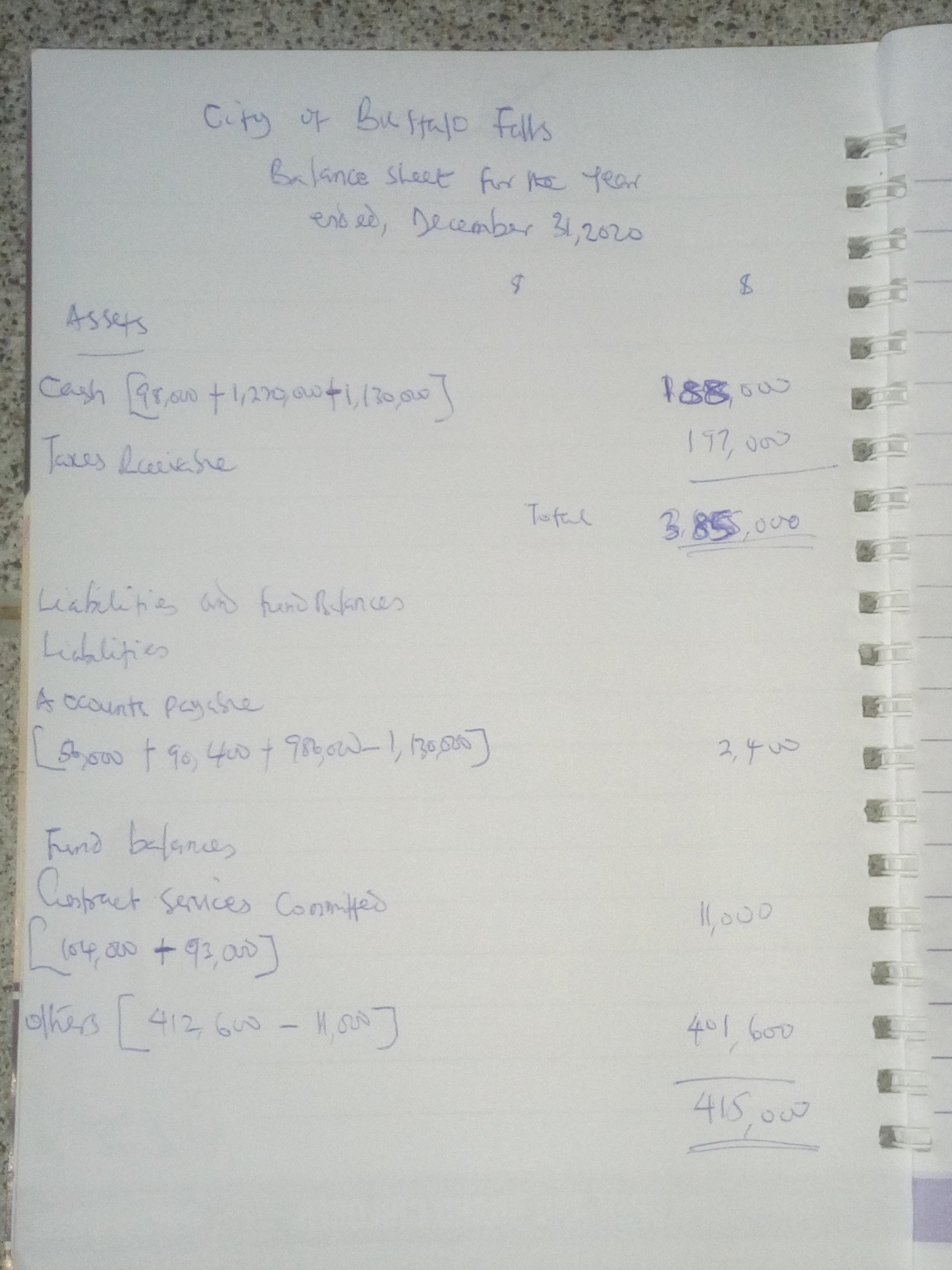

c. Prepare a Balance Sheet for the General Fund assuming there are no restricted or assigned net resources and outstanding encumbrances are committed by contractual obligation.

Answers

Answer:

Please see attached for the detailed solution.

Explanation:

a. Prepare Journal

b. Prepare statement

c. Prepare balance sheet

Please find attached solution to the above questions.

Related Questions

Sunland Diesel owns the Fredonia Barber Shop. He employs 4 barbers and pays each a base rate of $1,440 per month. One of the barbers serves as the manager and receives an extra $520 per month. In addition to the base rate, each barber also receives a commission of $9.15 per haircut. Other costs are as follows.

Advertising $240 per month

Rent $1,100 per month

Barber supplies $0.35 per haircut

Utilities $185 per month plus $0.10 per haircut

Magazines $35 per month Sunland currently charges $16 per haircut.

Vin currently charges $10 per haircut.

Required:

a. Determine the variable costs per haircut and the total monthly fixed costs.

b. Compute the break-even point in units and dollars.

c. Prepare a CVP graph, assuming a maximum of 1,800 haircuts in a month. Use increments of 300 haircuts on the horizontal axis and $3,000 on the vertical axis.

d. Determine net income, assuming 1,600 haircuts are given in a month.

Answers

Answer:

a. Variable costs = $9.60 and Fixed Costs = $7,840

b. 1,225 haircuts and $19,600

c. See attachment

d. $2,400

Explanation:

Variable Costs per haircut Calculations

Barber supplies $0.35

Utilities $0.10

Commission $9.15

Total Variable Costs per haircut $9.60

Total Monthly Fixed Costs Calculation

Base Salary (1,440 × 4 + 520) $6,280

Advertising $240

Rent $1,100

Utilities $185

Magazines $35

Total Monthly Fixed Costs $7,840

Contribution per unit = Selling price per unit - Variable Cost per unit

= $16.00 - $9.60

= $6.40

Contribution Margin Ratio = Contribution ÷ Selling Price

= $6.40 ÷ $16.00

= 0.40

Break-even point (units) = Fixed Cost ÷ Contribution per unit

= $7,840 ÷ $6.40

= 1,225 haircuts

Break-even point (dollars) = Fixed Cost ÷ Contribution Margin Ratio

= $7,840 ÷ 0.40

= $19,600

Net income, assuming 1,600 haircuts are given in a month [calculation]

Contribution (1,600 × $6.40) $10,240

Less Fixed Costs ($7,840)

Net Income/(loss) $2,400

Connors Bros., a Maritime seafood products manufacturer, hopes to attract Ontario consumers for its Brunswick sardines through a campaign pushing the small fish as a positive food choice. In the campaign, Conner encouraged consumers to buy more sardines. If consumers purchased more sardines, then supermarkets would stock more sardines, thus creating _____ for the small fish.

Answers

Answer:

Derived demand

Explanation:

Derived demand is defined as the demand for a product that occurs as a result of demand for another or similar product. For example the demand for factors of production can result from increased fans for a party product.

In the given scenario the campaign by Connors Bros. a Maritime seafood products manufacturer, hopes to attract Ontario consumers for its Brunswick sardines.

When there is increase in demand for sardines, supermarkets will stock up more sardines. Thereby increasing the demand for sardines.

The sardine demand by supermarkets is derived from the consumer demand for them.

Connors Bros. is trying to create a derived demand for the small fish business enterprise.

What is derived demand?

Derived demand is defined as the need for a unit of production or intermediate good that arises as a response to demand for another intermediate or final item is referred to as

From the information given, the demand for a unit of production by a business enterprise is determined by customer demand for the firm's product.

If the consumers of Brunswick sardines purchase more sardines, supermarkets that get these products from Connors Bros. will definitely stock more sardines.

Learn more about derived demands here:

https://brainly.com/question/4358080

Selected Information from Balance Sheets (As of Year End for Years 0 and 1)

Year 0 Year 1

Cash 1,000 2,000

Accounts Receivables 1,000 5,000

Inventory 5,000 4,000

Property, Plant and Equipment (net) 12,000 11,000

Accounts Payable 5,000 4,000

Unearned Revenue 2,000 1,000

Bonds Payable 5,000 6,000

Common Stock 3,000 4,000

Retained Earnings 5,000 7,000

Income Statement (Year 1)

Sales 20,000

Costs of Goods Sold (8,000)

Wage Expense (4,000)

Depreciation Expense (2,000)

Loss from PP&E Sale (1,000)

Net Income Before Tax 5,000

Tax Expense (2.000)

Net Income 3.000

In the space provided, prepare the Operating section of the statement of cash flow for Year 1, using the indirect approach.

Answers

Answer:

The Operating Activities section of the Statement of Cash Flow for Year 1:

Net Income $3,000

Add non-cash expenses:

Depreciation Expense 2,000

Loss from PP&E Sale 1,000

Operating cash flow 6,000

Changes working capital -5,000

Net cash flow from operating activities 1,000

Explanation:

Changes in working capital items:

Year 0 Year 1 Changes

Accounts Receivables 1,000 5,000 -4,000

Inventory 5,000 4,000 1,000

Accounts Payable 5,000 4,000 -1,000

Unearned Revenue 2,000 1,000 -1000

Net changes in working capital -5,000

What is a sum of money that is borrowed and is expected to be paid back with interest?

Answers

Explanation: when someone borrows money from someone else or even from the bank it is done on the condition that the money would eventually be paid back in a certain period of time with an interest payment

Glassworks Inc. produces two types of glass shelving, rounded edge and squared edge, on the same production line. For the current period, the company reports the following data.

Rounded Edge Squared Edge Total

Direct materials $ 9,500 $ 21,600 $ 31,100

Direct labor 6,200 11,800 18,000

Overhead (300% of direct labor cost) 18,600 35,400 54,000

Total cost $ 34,300 $ 68,800 $ 103,100

Quantity produced 10,500 ft. 14,000 ft.

Average cost per ft. (rounded) $ 3.27 $ 4.91

Glassworks's controller wishes to apply activity-based costing (ABC) to allocate the $54,000 of overhead costs incurred by the two product lines to see whether cost per foot would change markedly from that reported above. She has collected the following information.

Overhead Cost Category (Activity Cost Pool) Cost

Supervision $ 2,160

Depreciation of machinery 28,840

Assembly line preparation 23,000

Total overhead $ 54,000

She has also collected the following information about the cost drivers for each category (cost pool) and the amount of each driver used by the two product lines. (Round activity rate and cost per unit answers to 2 decimal places.)

Usage

Overhead Cost Category (Activity Cost Pool) Driver Rounded Edge Squared Edge Total

Supervision Direct labor cost ($) $ 6,200 $ 11,800 $ 18,000

Depreciation of machinery Machine hours 400 hours 800 hours 1,200 hours

Assembly line preparation Setups (number) 32 times 93 times 125 times

Required:

Use this information to (1) assign these three overhead cost pools to each of the two products using ABC, (2) determine average cost per foot for each of the two products using ABC, and (3) compare the average cost per foot under ABC with the average cost per foot under the current method for each product. For part 3, explain why a difference between the two cost allocation methods exists.

Answers

Answer:

Overhead Cost Category (Activity Cost Pool) Cost

Supervision $2,160

Depreciation of machinery $28,840

Assembly line preparation $23,000

Total overhead $54,000

Supervision

Direct labor cost ($) $6,200 $11,800 $18,000

Depreciation of machinery

Machine hours 400 hours 800 hours 1,200 hours

Assembly line preparation Setups (number)

32 times 93 times 125 times

1)

overhead costs assigned to Rounded Edge

supervision = $2,160 x ($6,200 / $18,000) = $744

depreciation = $28,840 x (400 / 1,200) = $9,613

assembly line preparation = $23,000 x (32/125) = $5,888

total overhead costs = $16,245

overhead costs assigned to Squared Edge

total overhead costs = $54,000 - $16,245 = $37,755

2)

total costs assigned to Rounded Edge

materials $9,500

direct labor $6,200

overhead $16,245

total $31,945

cost per foot = $31,945 / 10,500 = $3.0424 per foot

total costs assigned to Squared Edge

materials $21,600

direct labor $11,800

overhead $37,755

total $71,155

cost per foot = $71,155 / 14,000 = $5.0825 per foot

3)

The average cost per foot of Rounded Edge decreased because lower overhead costs were allocated to their production.

The average cost per foot of Squared Edge increased because higher overhead costs were allocated to their production.

Prepare a bank reconciliation as of October 31 from the following information:

a. The October 31 cash balance in the general ledger is $806.

b. The October 31 balance shown on the bank statement is $350.

c. Checks issued but not returned with the bank statement were No. 462 for $24 and No. 483 for $42.

d. A deposit made late on October 31 for $433 is included in the general ledger balance but not in the bank statement balance.

e. Returned with the bank statement was a notice that a customer's check for $80 that was deposited on October 25 had been returned because the customer's account was overdrawn.

f. During a review of the checks that were returned with the bank statement, it was noted that the amount of Check No. 471 was $65 but that in the company's records supporting the general ledger balance, the check had been erroneously recorded as a payment of an account payable in the amount of $56.

Answers

Answer:

Bank Reconciliation Statement as of October 31

Particulars Amount Particulars Amount

Balance as per bank $350 Balance as per books $806

Add: Late deposit $433 Less: Returned checks $80

Less: Outstanding check $66 Less: Error recordings $9

($24+$42) ($65-$56)

Reconciled Balance $717 Reconciled Balance $717

Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $900,000 of total manufacturing overhead for an estimated activity level of 75,000 machine-hours.

During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company’s warehouse. The company’s cost records revealed the following actual cost and operating data for the year:

Machine-hours 76,000

Manufacturing overhead cost $637,000

Inventories at year-end:

Raw materials $20,000

Work in process (includes overhead applied of $36,480) $115,800

Finished goods (includes overhead applied of $91,200) $289,500

Cost of goods sold (includes overhead applied of $480,320) $1,524,700

Required:

a. Compute the underapplied or overapplied overhead.

b. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

c. Assume that the company allocates any underapplied or over appliedoverhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

d. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold?

Answers

Answer:

Please solution below

Explanation:

a. Compute the under applied or over applied overhead

First, we need to determine the predetermined overhead rate.

Predetermined overhead rate = Estimated total manufacturing overhead / Estimated total machine hours

= $900,000 / 75,000 hours

= $12.0 per hour

But;

Actual manufacturing overhead = $637,000

Manufacturing overhead applied to work in process during the year = 76,000 actual MHs × $12.00 per MH $912,000

Over applied overhead cost = $275,000

b. Journal entry

Cost of goods sold Dr $275,000

To Manufacturing over head applied Cr $275,000

c. The over applied over head would be allocated using the following percentages;

Overhead applied during the year ;

Work in process = $36,480. 6%

Finished goods = $91,200. 15%

Cost of goods sold = $480,320 79%

Total = $608,000 100%

The entry to record the allocation of the overhead applied would be ;

Work in process [6% × $275,000] = $16,500

Finished goods [15% × $275,000] = $41,250

Cost of goods sold [79% × $275,000] = $217,250

d. Comparing the two method;

Cost of goods sold if the over applied overhead is closed to the cost of goods sold [$1,524,700 + $275,000] = $1,799,700

Cost of goods sold if the overhead applied is closed to work in process, finished goods, and cost of goods sold = [$1,524,700 + $217,250] =

$1,741,950

Difference in cost of goods sold = $57,750

The revenues budget identifies: a. expected cash flows for each product b. actual sales from last year for each product c. the expected level of sales for the company d. the variance of sales from actual for each product

Answers

Answer:

c. the expected level of sales for the company

Explanation:

Revenue/Sales Budget is the first budget to be prepared by most companies because most businesses are sales led.

This Budget shows, the expected level of sales for the company.

Use the information about Billy's Burgers to answer the following question(s):

Billy's Burgers

Figures in $ millions

Income Statement 2010 Balance Sheet 2010

Net Sales 246.0 Assets

Costs exc. Dep. 187.0 Cash 8.0

EBITDA 59.0 Accts. Rec. 21.0

Depreciation 17.2 Inventories 23.0

EBIT 41.8 Total Current Assets 52.0

Interest 12.0 Net PP&E 145.0

Pretax Income 29.8 Total Assets 197.0

Taxes 10.4

Net Income 19.4 Liabilities and Equity Accts.

Payable 18.0 LongTerm Debt 82.0

Total Liabilities 100.0 Total Stockholders' Equity 97.0

Total Liabilities and Equity 197.0

Required:

Using the percent of sales method, and assuming 20% growth in sales, estimate Billy's Burgers' Accounts Receivable for 2011.

a. $21.0 million

b. $18.0 million

c. $25.2 million

d. $21.6 million

Answers

Answer:

c. $25.2 million

Explanation:

Billy's Burgers' Accounts receivable 2011 = Accounts receivable 2010 *(1+Growth rate)

Billy's Burgers' Accounts receivable 2011 = $21,000,000 * (1+0.20)

Billy's Burgers' Accounts receivable 2011 = $21,000,000 * (1.20)

Billy's Burgers' Accounts receivable 2011 = $25,200,000.

Your firm has taken out a 521,000 loan with 8.6% APR (compounded monthly) for some commercial property. As is common in commercial real estate, the loan is a 5-year loan based on a 15-year amortization. This means that your loan payments will be calculated as if you will take 15 years to pay off the loan, but you actually must do so in 5 years. To do this, you will make 59 equal payments based on the 15-year amortization schedule and then make a final 60th payment to pay the remaining balance.

A. What will your monthly payments be?

B. What will your final payment be?

Answers

Answer:

A. What will your monthly payments be?

$5,161.08B. What will your final payment be?

$419,650Explanation:

loan = $521,000

interest rate = 8.6% compounded monthly

loan schedule = 15 years

monthly payment = loan amount / PV annuity factor, 0.7167%, 180 periods* = $521,000 / 100.94786 = $5,161.08

No annuity table will give you the annuity factor for 0.7167%, so you must search for an annuity calculator on the web.

Then I prepared an amortization schedule to determine the balance after the 59th payment (attached file). The balance after the 59th payment is $416,649 + $3,001 in interests = $419,650.

Assume a par value of $1,000. Caspian Sea plans to issue a 9.00 year, semi-annual pay bond that has a coupon rate of 8.04%. If the yield to maturity for the bond is 7.79%, what will the price of the bond be

Answers

Answer:

$1,015.96

Explanation:

The Price of the Bond (PV) can be calculated as follows :

Fv = $1,000

Pmt = ($1,000 × 8.04%) ÷ 2 = $40.20

n = 9 × 2 = 18

p/yr = 2

i = 7.79%

pv = ?

Using a financial calculator to input the values as shown above, the Price of the Bond (PV) is $1,015.96

Seiko’s current salary is $85,000. Her marginal tax rate is 32 percent and she fancies European sports cars. She purchases a new auto each year. Seiko is currently a manager for an Idaho Office Supply. Her friend, knowing of her interest in sports cars, tells her about a manager position at the local BMW and Porsche dealer. The new position pays only $75,000 per year, but it allows employees to purchase one new car per year at a discount of $15,000. This discount qualifies as a nontaxable fringe benefit. In an effort to keep Seiko as an employee, Idaho Office Supply offers her a $10,000 raise. Answer the following questions about this analysis.

Problem 12-41

Part a a. Assuming it has a 21 percent marginal tax rate, what is the annual after-tax cost to Idaho Office Supply to provide Seiko with the $10,000 increase in salary?

Answers

Answer:

$7,900

Explanation:

Calculation for the annual after-tax cost

Additional salary = $ 10,000

Marginal tax rate=21%

First step is to find the income tax benefit

Income tax benefit = $ 10,000 x 21%

Income tax benefit= $ 2,100

Second step is to find the Annual after tax cost of additional salary

Annual after tax cost of additional salary = $ 10,000 - $2,100

Annual after tax cost of additional salary = $7,900

Therefore the annual after-tax cost will be $7,900

Tawna Reed was hired for a top managerial position in Nike Corporation because she had creative ability and a good overall feel for the athletic shoe industry. Reed is said to have good _____ skills.

Answers

Answer:

C) conceptual.

Explanation:

Conceptual skills are essential in managers of large companies, such as that of the multinational Nike.

This ability means that the manager has a vision of the organization as an integrated system, where each part has its relevance in the organizational whole and must be considered in the processing, evaluation and planning of the strategies that will lead to organizational success.

Having conceptual skills means having the skills to have a diffuse and analytical thinking of the organization and all the parts that involve it, which makes the entire management decision-making process much more efficient and aligned with the organization's objectives and goals.

Suppose the following data were taken from the 2017 and 2016 financial statements of American Eagle Outfitters. (All numbers, including share data, are in thousands.)

2017 2016

Current assets $ 890,400 $999,600

Total assets 1,950,000 1,878,000

Current liabilities 424,000 357,000

Total liabilities 573,300 552,132

Net income 166,830 337,600

Net cash provided by operating activities 300,000 452,600

Capital expenditures 271,000 246,500

Dividends paid on common stock 85,000 76,500

Weighted-average shares outstanding 201,000 211,000

a. Calculate the current ratio for each year. (Round answers to 2 decimal places, e.g. 15.25.)

2017 2016

Current ratio

b. Calculate earnings per share for each year. (Round answers to 2 decimal places, e.g. 15.25.)

2017 2016

Earnings per share $

c. Calculate the debt to assets ratio for each year. (Round answers to 1 decimal place, e.g. 29.5%)

2017 2016

Debt to assets ratio

d. Calculate the free cash flow for each year. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).)

2017 2016

Free cash flow

Answers

Answer:

Please see below

Explanation:

a. Current ratio

= Total current asset / Total current liabilities

2017

Current asset. 890,400

Current liabilities 424,000

Current ratio = 890,400/424,000

= 2.1

2016 Current ratio

Current asset. 999,600

Current liabilities 357,000

Current ratio = 999,600/357,000

= 2.8

b. Earnings per share

= (Net income - Preference dividend) / Weighted average number of shares outstanding

2017

Net income. 166,830

Weighted Average number of shares outstanding 201,000

Earnings per share = $166,830/201,000

= $0.83

2016 Earnings per share

Net income $337,600

Weighted Average number of shares outstanding 211,000

Earnings per share = $337,600/211,000

= $1.6

c. Debt to asset ratio

= Total liabilities / Total assets

2017

Total liabilities 573,300

Total assets 1,950,000

= 573,300/1,950,000

= 0.29

2016 Debt to asset ratio

Total liabilities 552,132

Total assets 1,878,000

Debt to asset ratio = 552,132/1,878,000

= 0.29

d. Free cash flow

2017

Cash flow from operating activities 300,000

Less: capital expenditure (271,000)

Free cash flow 29,000

2016 free Cash flow from operating activities

Free cash flow 452,600

Less: capital expenditure (246,500)

Free cash flow. 206,100

A stock has an average expected return of 10.8 percent for the next year. The beta of the stock is 1.22. The T-Bill rate is 5% and the T-Bond rate is 3.4 %. What is the market risk premium

Answers

Answer: 4.7%

Explanation:

Expected return is calculated as:

= Risk free return + Beta ( Market risk premium)

10.8% = 5% + (1.22 × Market risk premium)

10.8% - 5% = 1.22market risk premium

5.8%/1.22 = market risk premium

Market risk premium = 0.058/1.22

Market risk premium = 0.047

Market risk premium = 4.7%

Read the following sentences, and identify the error.

a. Paolo recruited job applicants for the company that showed promise.

The error in this sentence is a:_________ .

b. We will be visiting our accounts in California, Oregon, and visiting our accounts in Washington.

The error in this sentence is a:________ .

Before you decide whether to use passive or active voice, you should consider the purpose of your message and the nature of the situation. Read the scenario, and then fill in the blanks.

You work for a printing company, and you realize that your colleague sent incorrect price quotes to a client. You begin to write an e-mail to the client to apologize for the mistake. You want to remedy the situation without criticizing your colleague. The sentence excerpted from the e-mail uses ______________ voice. Given the purpose of your message, this voice ___________ appropriate.

Answers

Answer:

a. Paolo recruited job applicants for the company that showed promise.

The error in this sentence is a: AMBIGUITY.

Who showed promise? The company or the job applicants? This sentence is not specific and you really cannot tell whether the job applicants or the company showed promise.

b. We will be visiting our accounts in California, Oregon, and visiting our accounts in Washington.

The error in this sentence is a: LACK OF PARALLELISM.

In order to show parallelism you should include the dates of the visits, since you cannot visit all 3 states in the same day and do your work properly.You work for a printing company, and you realize that your colleague sent incorrect price quotes to a client. You begin to write an e-mail to the client to apologize for the mistake. You want to remedy the situation without criticizing your colleague.

The sentence is missing, so I looked for a similar question:

"Bill made an error when he was processing your invoice."

The sentence excerpted from the e-mail uses ACTIVE voice. Given the purpose of your message, this voice IS NOT appropriate.

The whole purpose of this message is to solve a problem without criticizing Bill, but by using active voice, you are directly criticizing him.Maisie Taft started her own consulting firm, Maisie Consulting, on May 1, 2020. The following transactions occurred during the month of May.

May 1 Maisie invested $7,000 cash in the business.

2 Paid $900 for office rent for the month.

3 Purchased $800 of supplies on account.

5 Paid $125 to advertise in the County News.

9 Received $4,000 cash for services performed.

12 Withdrew $1,000 cash for personal use.

15 Performed $6,400 of services on account.

17 Paid $2,500 for employee salaries.

20 Made a partial payment of $600 for the supplies purchased on account on May 3.

23 Received a cash payment of $4,000 for services performed on account on May 15.

26 Borrowed $5,000 from the bank on a note payable.

29 Purchased equipment for $4,200 on account.

30 Paid $275 for utilities.

Questions:

A. Prepare an income statement for the month of May.

B. Prepare a balance sheet at May 31, 2020.

Answers

Answer:

A. NET INCOME $6,600

B. TOTAL ASSETS $22,000

TOTAL LIABILITIES AND EQUITY $22,000

Explanation:

A. Preparation of income statement for the month of May.

Maisie Taft INCOME STATEMENT for May 2020

Service Revenue $10,400

($4,000 + $6,400)

Less: Expenses

Rent expense ($900)

Advertising expense ($125)

Salaries expense ($2,500)

Utilities expense ($275)

NET INCOME $6,600

Therefore the Net income on the income statement for the month of May 2020 will be $6,600

B. Preparation of balance sheet at May 31, 2020

Maisie Taft BALANCE SHEET at May 31, 2020

ASSETS:

Cash $14,600

Accounts receivable $2,400

Supplies $800

Equipment $4,200

TOTAL ASSETS $22,000

(14,600+2,400+800+4,200)

LIABILITIES:

Accounts payable $4,400

Notes payable $5,000

Total liabilities $9,400

($4,400+$5,000)

EQUITY:

Owner's equity $7,000

Retained earnings $5,600

($6,600 - $1,000)

Total equity $12,600

($7,000+$5,600)

TOTAL LIABILITIES AND EQUITY $22,000

($9,400 + $12,600)

CASH

May 1 Cash $7,000

2 Paid Office rent ($900)

5 Paid to advertise ($125)

9 Cash Received $4,000

12 Cash Withdrew ($1,000)

17 Paid employee salaries ($2,500)

20 Supplies purchased ($600)

23 Cash payment $4,000

26 Note payable $5,000

30 Utilities ($275)

CASH $14,600

ACCOUNT RECEIVABLES

May 15 $6,400

May 23 ($4,000)

ACCOUNT RECEIVABLES $2,400

ACCOUNT PAYABLE

May 3 $800

May 20 ($600)

May 29 $4,200

ACCOUNT PAYABLE $4,400

Therefore the Total asset on the balance sheet at May 31, 2020 will be $22,000 and the Total liabilities and equity on the balance sheet at May 31, 2020 will be $22,000

Kim is trying to decide whether she can afford a loan she needs in order to go to chiropractic school. Right now Kim is living at home and works in a shoe store, earning a gross income of $1,760 per month. Her employer deducts $199 for taxes from her monthly pay. Kim also pays $189 on several credit card debts each month. The loan she needs for chiropractic school will cost an additional $172 per month. Help Kim make her decision by calculating her debt payments-to-income ratio with and without the college loan.

Required:

a. Carl’s house payment is $1,640 per month and his car payment is $482 per month. If Carl's take-home pay is $3,250 per month, what percentage does Carl spend on his home and car?

b. Suppose that your monthly net income is $2,850. Your monthly debt payments include your student loan payment and a gas credit card. They total $1,140. What is your debt payments-to-income ratio?

Answers

Answer:

1. Kim:

Debt payments-to-income ratio with the college loan

= 23%

2. Carl:

Percentage spent on home and car

= 65.3%

3. Debt payment to income ratio

= 40%

Explanation:

Kim's Data and Calculations:

Gross income = $1,760

Income taxes -199

After Tax Income $1,561 per month

Credit card debts = $189 per month

School loan = $172 per month

Total Debt payments = $361

Debt payments-to-income ratio with the college loan

= $361/$1,561 = 23%

Carl:

House payment = $1,640

Car payment = $482

Total payments = $2,122

Take-home pay = $3,250

Percentage spent on home and car = 65.3% ($2,122/$3,250 * 100)

3. My monthly net income = $2,850

Monthly debt payments = $1,140

Debt payment to income ratio

= $1,140/$2,850 * 100

= 0.4

= 40%

The following inventory information is available for Ricci Manufacturing Corporation for the year ended December 31, 2017:

Beginning Ending

Inventories: Raw materials $17,000 $19,000

Work in process 9,000 14,000

Finished goods 11,000 8,000

Total $37,000 $41,000

In addition, the following transactions occurred in 2017:

1. Raw materials purchased on account, $75,000.

2. Incurred factory labor, $80,000, all is direct labor. (Credit Factory Wages Payable).

3. Incurred the following overhead costs during the year: Utilities $6,800, Depreciation on manufacturing machinery $8,000, Manufacturing machinery repairs $9,200, Factory insurance $9,000 (Credit Accounts Payable and Accumulated Depreciation).

4. Assigned $80,000 of factory labor to jobs.

5. Applied $36,000 of overhead to jobs. Instructions

Required:

a. Journalize the above transactions.

b. Reproduce the manufacturing cost and inventory accounts.

c. From an analysis of the accounts, compute the following:

1. Raw materials used.

2. Completed jobs transferred to finished goods.

3. Cost of goods sold.

4. Under- or overapplied overhead.

Answers

Answer:

Ricci Manufacturing Corporation

a. Journal Entries;

1. Debit Raw Materials Inventory $75,000

Credit Accounts Payable $75,000

To record the purchase of materials on account.

2. Debit Factory Wages $80,000

Credit Factory Wages Payable $80,000

To record factory labor incurred on account.

3. Debit Manufacturing Overhead:

Utilities $6,800

Depreciation $8,000

Machinery Repairs $9,200

Factory Insurance $9,000

Credit: Accounts Payable $25,000

Accumulated Depreciation $8,000

To record manufacturing overhead costs incurred.

4. Debit Work in Process $80,000

Credit Factory Wages $80,000

To record the assignment of factory labor to jobs.

5. Debit Work in Process $36,000

Credit Manufacturing Overheads $36,000

To apply overhead to jobs.

b. Manufacturing cost and Inventory Accounts:

Raw Materials

Accounts Titles Debit Credit

Balance $17,000

Accounts payable 75,000

Work in Process 73,000

Balance $19,000

Work in Process

Accounts Titles Debit Credit

Balance $9,000

Raw materials 73,000

Factory Wages 80,000

Manuf. Overhead 36,000

Finished Goods $184,000

Balance $14,000

Finished Goods

Accounts Titles Debit Credit

Balance $11,000

Work in Process 184,000

Cost of goods sold $187,000

Balance $8,000

c. Computation of:

1. Raw materials used

= Beginning Inventory + Purchases - Ending Inventory

= $17,000 + $75,000 - $19,000

= $73,000

2. Completed jobs transferred to finished goods

= Beginning WIP + Raw materials used + Labor + Overhead - Ending WIP

= $9,000 + $73,000 + $80,000 + $36,000 - $14,000

= $184,000

3. Cost of goods sold

= Beginning Finished Goods + Manufacturing Costs - Ending Finished Goods

= $11,000 + $184,000 - $8,000

= $197,000

4. Under- or overapplied overhead

= Total Incurred manufacturing overhead - applied manufacturing overhead

= $33,000 - $36,000

= $3,000 over-applied

Explanation:

a) Data:

Beginning Ending

Inventories:

Raw materials $17,000 $19,000

Work in process 9,000 14,000

Finished goods 11,000 8,000

Total $37,000 $41,000

Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to an individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2005). Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire year. Thus, Marc and Michelle are allowed to claim a $1,000 child tax credit for Matthew. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions and they had a total of $5,500 in federal income taxes withheld from their paychecks during the course of the year. (use the 2016 tax rate schedules).

1. What is the total amount of Marc and Michelle’s deductions from AGI?

2. What is Marc and Michelle’s taxable income?

3. What is Marc and Michelle’s taxable income?

Answers

Answer:

$24750

$47750

Explanation:

Total amount of Marc and Michelle's deduction. From AGI:

MAX of (ITEMIZED DEDUCTION or MARRIED FILING JOINTLY)

2016 TAX SCHEDULE :

STANDARD DEDUCTION FOR MARRIED FILING JOINTLY = $12600

Personal and dependency deduction = 4,050

(4050 * 3). = $12,150

Deduction from AGI = $12,600 + $12,150 = $24750

Taxable income :

Gross income = (Marc and Michelle's salary + corporate bond)

= $(64000 + 12000 + 500) = $76500

Contribution + alimony = ($2500 + $1500) = 4000

Taxable income = ($76500 - 4000 - 24750) = $47750

A company issues $50 million of bonds at par on January 1, 2018. The bonds pay 10% interest semi-annually on 12/31 and 6/30 and mature in 20 years. The journal entry when the bonds are sold is:

Answers

Answer: Please see explanation for answer

Explanation:

Journal entry to record sale of bonds

Account titles Debit Credit

Cash $50,000,000

Bonds Payable $50,000,000

This activity is important because as world trade has grown, more companies have entered the global market. Once a firm decides to enter the global market, it must choose which means of market entry is the most appropriate. The global market entry strategies vary greatly on the dimensions of financial commitment, risk, marketing control, and profit potential.

The goal of this exercise is to demonstrate your understanding of the different types of global market entry strategies: exporting, licensing, joint venture, and direct investment. Roll over each company name to read the description of the firm's strategy, then drop it onto the correct global market entry strategy within the graphic.

1. Yoplait

2. Moodmatcher lipstick

3. McDonald's

4. Ericsson and CGCT

5. Boeing

6. Nissan

A. Indirect Exporting

B. Direct Exporting

C. Licensing

D. Franchising

E. Joint Venture

F. Direct Investment

Answers

Answer:

1. Yoplait ⇒ C. Licensing . Yoplait is the largest yogurt license in the world.

2. Moodmatcher lipstick ⇒ A. Indirect Exporting . It produces their products in the US and then sells them abroad through trading companies.

3. McDonald's ⇒ D. Franchising . McDonald's is one of the largest franchises in the world and it operates in a similar manner everywhere.

4. Ericsson and CGCT ⇒ E. Joint Venture . Ericsson is a Swedish telecommunications company and CGCT is a French company.

5. Boeing ⇒ B. Direct Exporting . Boeing is America's largest exporter. It opened its first overseas facility on December 15, 2018, in response to the trade dispute between China and the US. But the vast majority of its planes are still built int eh US.

6. Nissan ⇒ F. Direct Investment. Nissan is part of a French-Japanese car company that produces its cars on their own plants located around the world.

How much would the Gerrards have to put down if the lender required a minimum 20 percent down payment

Answers

Answer:

the first part of the question is missing, so I looked for similar questions to fill in the blanks:

Ben and Marie Gerrard, both in their mid-20s, have been married for 4 years and have two preschool-age children. Ben has an accounting degree and is employed as a cost accountant at an annual salary of $63,000. They're now renting a duplex but wish to buy a home in the suburbs of their rapidly developing city. They've decided they can afford a $210,000 house and hope to find one with the features they desire in a good neighborhood.

If the Gerrards are required to make a minimum 20% down payment, then they need to pay at least $210,000 x 20% = $42,000.

Many lenders require a minimum down payment for a mortgage loan and others charge different interest rates depending on the down payment percentage, e.g. if your down payment represents 30% of the house's value, the interest rate will be lower than a loan with a 20% down payment. The logic behind this is that the higher the down payment, the safer the loan.

"Ayres Services acquired an asset for $80 million in 2021." The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). Ayers deducted 100% of the asset's cost for income tax reporting in 2021. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2021, 2022, 2023, and 2024 are as follows: ($ in millions)

2021 2022 2023 2024

Pretax accounting income $330 $350 $365 $400

Depreciation on the income statement 20 20 20 20

Depreciation on the tax return (80 ) (0 ) (0 ) (0 )

Taxable income $270 $370 $385 $420

For December 31 of each year, determine:

a. The cumulative temporary book-tax difference for the depreciable asset.

b. The balance to be reported in the deferred tax liability account.

Answers

Answer:

a. The cumulative temporary book-tax difference for the depreciable asset are as follows:

December 31, 2021 = $60 million

December 31, 2022 = $40 million

December 31, 2023 = $20 million

December 31, 2024 = $0

b. The balance to be reported in the deferred tax liability account are as follows.

December 31, 2021 = $15 million

December 31, 2022 = $10 million

December 31, 2023 = $5 million

December 31, 2024 = $0

Explanation:

Note: See the attached excel file for the calculation of cumulative temporary book-tax difference for the depreciable asset and the balance to be reported in the deferred tax liability account for December 31 of years 2021, 2022, 2023 and 2024 in bold red color.

In the attached excel file, the following formula are used:

Cumulative Temporary differences at December 31 of the current year = Cumulative Temporary differences at December 31 of the previous year + (Depreciation on the tax return at December 31 of the current year - Depreciation on the income statement at December 31 of the current year)

Balance to be reported in deferred tax liability account at December 31 of the current year = Cumulative Temporary differences at December 31 of the current year * Tax rate

The following events pertain to James Cleaning Company:

1. Acquired $15,000 cash from the issue of common stock.

2. Provided services for $6,000 cash.

3. Provided $18,000 of services on account.

4. Collected $11,000 cash from the account receivable created in Event 3.

5. Paid $1,400 cash to purchase supplies.

6. Had $100 of supplies on hand at the end of the accounting period.

7. Received $3,600 cash in advance for services to be performed in the future.

8. Performed one-half of the services agreed to in Event 7.

9. Paid $6,500 for salaries expense.

10. Incurred $2,800 of other operating expenses on account.

11. Paid $2,100 cash on the account payable created in Event 10.

12. Paid a $1,000 cash dividend to the stockholders.

Required:Show the effects of the events on the financial statements using a horizontal statements model like the following one. In the Cash Flows column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity, NC for net change in cash and NA to indicate accounts not affected by the event. The first event is recorded as an example. (Enter any decreases to account balances and cash outflows with a minus sign

Answers

Answer:

I used an excel since there is not enough room here.

Explanation:

Below is the Retained Earnings account for the year 2020 for Swifty Corp. Retained earnings, January 1, 2020 $261,300 Add:_______.

Gain on sale of investments (net of tax) $44,900

Net income 88,200

Refund on litigation with government, related to the year 2017 (net of tax) 25,300

Recognition of income earned in 2019, but omitted from income statement in that year (net of tax) 29,100 187,500 448,800

Deduct:

Loss on discontinued operations (net of tax) 38,700

Write-off of goodwill (net of tax) 63,700

Cumulative effect on income of prior years in changing from LIFO to FIFO inventory valuation in 2020 (net of tax) 26,900

Cash dividends declared 35,700 165,000

Retained earnings, December 31, 2020 $283,800

Prepare a corrected retained earnings statement. Waterway Corp. normally sells investments of the type mentioned above. FIFO inventory was used in 2020 to compute net income. (List items that increase adjusted retained earnings first.)

Answers

Answer:

Swifty Corp.

Retained Earnings Statement

Retained earnings, January 1, 2020 $261,300

Correction of error from prior period $29,100

Adjustment for change in accounting principle - $26,900

Retained earnings, January, Adjusted $263,500

Add Net Income $56,000

Less Cash dividend -$35,700

Retained earnings, December 31, 2020 $283,800

Workings

Net Income $88,200

+ Gain on sale of investments (net of tax) $44,900

Refund on litigation with government $22,530

$158,400

- Loss on discontinued operation $38,700

Write-off of goodwill $63,700

Net Income $56,000

Comfort chair company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 73,000 chairs. During the month, the firm completed 78,000 chairs, and transferred them to the Finishing Department. The firm ended the month with 10,000 chairs in ending inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is used by Comfort. Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.

Beginning inventory:

DIrect materials $24,000

Conversion costs $35,000

Manufacturing costs added during the accounting period:

Direct materials $168,000

Conversion costs $278,000

1. What were the equivalent units for conversion costs during February? (HINT: The answer is 81,500, but I need work to support this)

2. What is the amount of direct materials cost assigned to ending work-in-process inventory at the end of February? (HINT: The answer is $23,000, but I need work to support this)

Answers

Answer:

1) total equivalent units:

materials = 73,000

conversion = 81,500

2) costs assigned to ending WIP:

materials = $23,013.70

conversion = $27,288.32

Explanation:

beginning WIP 78,000 + 10,000 - 73,000 = 15,000

materials = 100% (0 added during the period)

conversion = 30% (70% added during the period, 10,500 EU)

units started 73,000

units finished 78,000

units started and finished = 63,000

ending WIP 10,000

materials = 100%

conversion = 80%, 8,000 EU

Beginning WIP

Materials $24,000

Conversion $35,000

Costs added during the period:

Materials $168,000

Conversion $278,000

total equivalent units:

materials = 73,000

conversion = 10,500 + 63,000 + 8,000 = 81,500

cost per EU:

Materials = $168,000 / 73,000 = $2.30137

Conversion = $278,000 / 81,500 = $3.41104

costs assigned to ending WIP:

materials = 10,000 x $2.30137 = $23,013.70

conversion = 8,000 x $3.41104 = $27,288.32

The following is a partial trial balance for the Green Star Corporation as of December 31, 2021:

Account Title Debits Credits

Sales revenue 1,400,000

Interest revenue 35,000

Gain on sale of investments 55,000

Cost of goods sold 740,000

Selling expenses 185,000

General and administrative expenses 80,000

Interest expense 45,000

Income tax expense 135,000

There were 100,000 shares of common stock outstanding throughout 2021.

Required:

Prepare a single-step income statement for 2021, including EPS disclosures.

Prepare a multiple-step income statement for 2021, including EPS disclosures.

Answers

Answer:

1. Single-Step Income

Income statement

Revenues and gains: Amount$

Sales revenue 1,400,000

Interest revenue 35,000

Gain on sale of investment 55,000

Total revenues and gains 1,490,000

Expenses and losses

Cost of goods sold 740,000

General and administrative 80,000

expenses

Selling expenses 185,000

Interest expense 45,000

Total expenses and losses 1,050,000

Income before income tax 440,000

Income tax expense -135,000

Net income 305,000

EPS = Net income/Number of common shares

EPS = 305,000/100,000

EPS = 3.05

2. Multi-Step Income

Income statement

Particulars Amount$

Sales 1,400,000

Cost of goods sold -740,000

Gross profit 660,000

Operating expenses

General and administrative 80,000

expenses

Selling expenses 185,000

Total operating expenses -265,000

Operating income 395,000

Other incomes and expenses

Interest revenue 35,000

Gain on sale of investment 55,000

Interest expense -45,000

Total other income, net 45,000

Income before income tax 440,000

Income tax expense -135,000

Net income $305,000

EPS = Net income/Number of common shares

EPS = 305,000/100,000

EPS = 3.05

__________ provides a snapshot of the financial condition of the firm at a particular time. Multiple Choice The balance sheet The income statement The statement of cash flows All of the options are correct. None of the options are correct.

Answers

Answer:

The balance sheet

Explanation:

In a balance sheet, one can see the information on the assets of the company, their liabilities and the equity brought by the shareholders at any particular point in time.

In some cases, it can be referred to as statement of net worth because one can be able to see what the company owns and owes and how the assets are financed either as equity or debt.

Your company assembles five different models of a motor scooter that is sold in specialty stores in the United States. The company uses the same engine for all five models. You have been given the assignment of choosing a supplier for these engines for the coming year. Due to the size of your warehouse and other administrative restrictions, you must order the engines in lot sizes of 1,000 units. Because of the unique characteristics of the engine, special tooling is needed during the manufacturing process for which you agree to reimburse the supplier. Your assistant has obtained quotes from two reliable engine suppliers and you need to decide which to use. The following data have been collected:

Requirements (annual forecast) 12,000 units

Weight per engine 22 pounds

Order processing cost $125 per order

Inventory carry cost 20 percent of the average value of inventory per year

Assume that half of lot size is in inventory on average (1,000/2 = 500 units).

Two qualified suppliers have submitted the following quotations:

ORDER QUANTITY SUPPLIER 1 UNIT PRICE SUPPLIER 2 UNIT PRICE

1 to 1,499 units/order $510.00 $505.00

1,500 to 2,999 units/order 500.00 505.00

3,000 + units/order 490.00 488.00

Tooling costs $22,000 $20,000

Distance 125 miles 100 miles

Your assistant has obtained the following freight rates from your carrier:

Truckload (40.000 lbs. each load): $0.80 per ton-mile

Less-than-truckload: $1.20 per ton-mile

Required:

a. Calculate the total cost for each supplier.

b. Which supplier would you select?

c. If you could move the lot size up to ship in truckload quantities, calculate the total cost for each supplier.

d. Would your supplier selection change?

Answers

Answer:

a. Cost of Supplier 1 : $6,214,300 per year

Cost of Supplier 2 : $6,147,840

b. Supplier 2 will be selected as it costs $66,460 less than supplier 1.

c. 1,818

d. No.

Explanation:

Supplier : 1 ; 2

Unit price : $510 ; $505

Annual Purchase cost: $6,120,000 ; $6,060,000

One time cost: $22,000 ; $20,000

Orders per year: 12 , 12

Order processing cost: $1,500 ; $1,500

Inventory carrying cost: $51,000 ; $50,500

Distance: 125 ; 100

Weight per load: 22000

Transportation: $19,800 ; $15,840

Total Cost : $6,214,300 ; $6,147,840

Annual Purchase Cost = Demand * Units price

Orders per year = Demand / Lot size

Inventory Carrying cost = [ Lot size / 2 ] * Carrying cost * unit price

Order processing cost = Number of orders * order processing cost.

c. Required lot size for truck : 40,000 / 22 ≈ 1,818