Answers

Answer:

see below

Explanation:

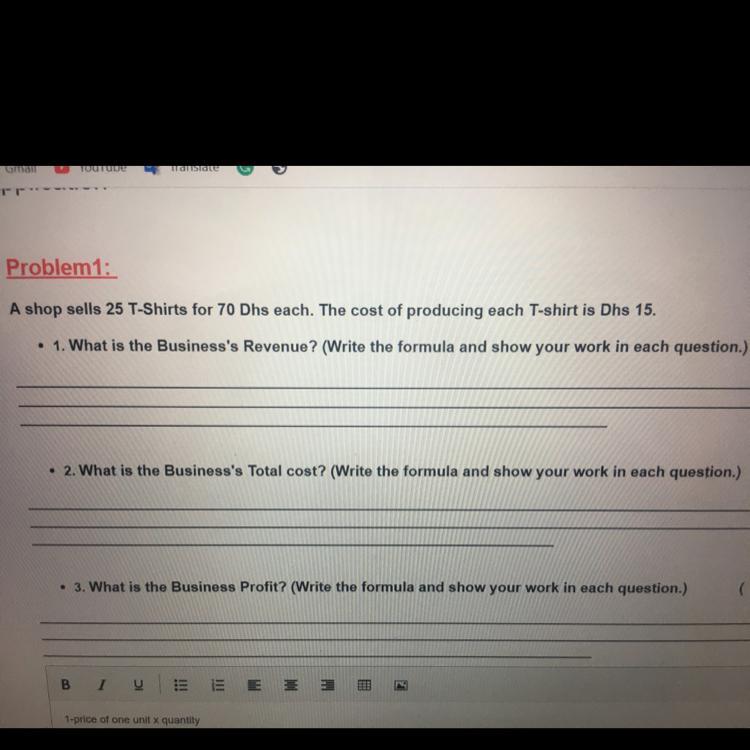

1. Business Revenue

Revenue is the income generated from normal business operations. In this case, normal business operations are selling T-shirts.

The shop sold 25 t-shirts at 70 Dhs each.

Revenue is quantity sold multiplied by sales price

i.e., Revenue = quantity sold x selling price per unit

=70 x 25 Dhs

=1,750 Dhs

2. Business total cost

Costs are the expenses incurred in producing goods intended for sale.

The cost of producing one t-shirt is 15 Dhs.

The cost of producing 70 t-shirts will be.

Total cost = total quantity produced x unit cost

= 70 x 15 Dhs

=1,050 Dhs

3. Business profit

Profit is the income earned from business operation after deducting the cost from the revenues.

I.e., profits = revenue - cost

For this shop

profits = 1,750 Dhs - 1,050 Dhs

Profits = 700 Dhs

Related Questions

The worst possible consequence of conflict is ______. a. Stress b. Hurtful words c. Damaged relationships d. Violence Please select the best answer from the choices provided A B C D

Answers

Answer:

Explanation:

Violence

The worst possible consequence of conflict is Violence. Thus the correct option is D.

What is a conflict?Conflicts refer to situations when two individuals involved in a conversation share differences of opinions which causes disagreement between them and creates arguments in order to prove them stronger conflicts raises.

Conflicts can be a foundation for violence, most confrontations have a favorable outcome and do not escalate to violence. When there is a difference of opinion and no resolution is found, it enrages people and leads to violence.

When two parties believe that their objectives are incompatible, conflict develops. The diverse ways senior managers are rewarded within a company frequently lead to contradictory aims.

Therefore, option D is appropriate.

Learn more about conflict, here:

https://brainly.com/question/29456718

#SPJ3

Examine the four different companies in the table, which shows their yearly

income and their tax rate. Which type of taxation does this table best

represent?

Tax rate

20%

Total income

$50 million

$100 million

$150 million

$200 million

Company A

Company B

Company C

Company D

15%

12%

10%

A. Regressive

B. Progressive

C. Indirect

D. Proportional

Answers

The Type of taxation this table represent is Option A Regressive Tax.

Type of TaxationThere are mainly four types of Taxes, these are Regressive, progressive, Indirect, and Proportional. In the given question the Regressive Taxation system is represented.

A Regressive Taxation system is one where Companies which have lower income have higher tax rate in comparison to big companies. In the given question the company which have lowest income is giving 15% of total income, while the largest company is giving 10% of their income.

Learn More about Taxation System here:

https://brainly.com/question/782502

Answer:proportional

Explanation:just took the testt

HELP PLEASEEEE!!

Which of the following is unsecured short-term debit that a financial manager looks for as a low risk investment with a high return?

A. Commercial paper

B. Certificates of deposits

C. Equity Fiancing

D. short term loans

Answers

Answer:

hello dude b is the correct answer

please make me brainiest

Explanation:

hope it's helpful in future

If you saw a coworker take something from the clinic what would you do?

Answers

Answer:

Um I would either tell them that he took it or i would just not worry about

Answer:

Join him.......

(a) Where the parent company does not hold 100 percent equity of the subsidiary company, what portion of the intra-group transactions between the parent entity and the subsidiary entity will need to be eliminated on consolidation? (2 marks) (b) What is a non-controlling interest, and how should it be disclosed? (2 marks) (c) How are non-controlling interests affected by intra-group transactions? (2 marks) (d) What are the three steps we use to calculate total non-controlling interest? (1 mark)

Answers

Answer:

Follows are the solution to this question:

Explanation:

In point a:

If the parent firm doesn't hold the conglomerate's equity stake, depreciation expense acknowledged by the parent company's owner and expenditures shall be removed throughout the consolidated statement of financial position. Its combined cash flow deletes debts previously recognized as assets for both the parent corporation and as debts for all the subsidiaries to offer a real and equal view. All the intragroup balance should be removed to avoid double-counting of financial assets resulting from payments in between the group's members.

In point b:

If a parent company has a stake in a subsidiary that is called noncontrolling interest over 50%, but less than 99 percent. Its parent company shall report a different non-controlling interest line on the income statement and revenue report to reveal its noncontrolling interest.

In point c:

Its Group of non - management Concerns may not claim responsibility mostly on a share of a benefit, doesn't have any influence from over parent's decision. Intra-group payments in a word-level shall be removed.

In point d:

Its NCI share of the opening in net assets of the subsidiary + NCI share of even an amortization fair value + NCI profits due to NCI - (dividend payable to the noncontrolling shareholder) = unlawful interest at the date of the merger is three steps for the calculation of total the uncontrol value.

What's the difference between enterprise and generic competion?

Answers

Jacques designs and produces blankets. The selling price for each blanket is $25. Jacques spends $7.50 on the wool and thread to produce each blanket. For each blanket that Jacques produces, he pays himself $10.

What is the added value for Jacques’ blankets?

please help

Answers

Answer:

$7.50

Explanation:

Added value is the increase in value arising from the production process. It is between the price of the finished good or services and the cost of inputs.

For Jacques's blankets, the cost of inputs will be labor plus materials.

=$7.50 + $10 = $17.50

The selling price is $25.

Added value

= $25- $17.50

=$7.50

The benefits of a strategic business plan do not include _____.:

Answers

Answer:

Early precautionary measures of trouble ahead can not be issued.

Explanation:

Since a strategic strategy maps out a path for the organisation to follow, it will enable it tighten its attention in order to get somewhere. Therefore, strategic preparation will help the organisation create the best priorities and strategies and help others concentrate their energies on achieving them.

Perform online or offline research to learn more about how farmers, ranchers, and other stakeholders in the United States practice sustainable or alternative agriculture. Pick a few that interest you and write a report describing their efforts, methods, and results.

Answers

Answer:

Organic Farming-The natural cultivating development makes a difference to anticipate water contamination and other natural harm whereas expanding yields. A few considers have appeared that corn plants, developed naturally, can deliver up to 30% more corn than when developed customarily. Not as it were are you getting more from your trim, but you’re finishing the same errand without jeopardizing your nearby environment.

Crop Rotation-Edit revolution depends on three diverse sorts of crops — cash, filler and cover. Your cash crops are the ones you’re getting to be making cash off of or eating yourself. Filler crops keep the field from going neglected amid the low season whereas regularly contributing to soil wellbeing and richness, and cover crops do the same without requiring much observing or support.

Regenerative Farming-Regenerative cultivating is another ancient concept that takes the thought of trim revolution to a entire nother level. Rather than treating the soil like a device to be utilized and disposed of, regenerative cultivating methods treat agribusiness like it’s part of the arrive instead of something isolated from it. In expansion to things like edit turn, regenerative cultivating minimizes working to protect soil accumulation, relies on characteristic fertilizers like compost and fertilizer instead of chemical options and takes all fundamental steps to avoid the cultivating from pulverizing the nearby environment.

Explanation:

HELP PLZ WILL GIVE BRAINLIEST. Click this link to view O*NET’s Tasks section for Human Resources Managers. Note that common tasks are listed toward the top, and less common tasks are listed toward the bottom. According to O*NET, what are some common tasks performed by Human Resources Managers? Check all that apply.

Answers

Answer:

the awnser to this question is A C D F i promise these are right i had the same question

Explanation:

mark brainliest pls

it is A, C, D, F

Explanation:

I just answered it

Situation 3

• You have some friends that have a lot of money. They want to make more

money by loaning their money to other people.

• You also have friends that want to buy apartments in a cool new

development, but they don't have any money. You introduce your friends

who want to buy to your friends who have money to lend.

In the home buying business, what would you be called?

O A landlord.

O A loan officer.

O A mortgage broker.

O A mortgagor.

Answers

In the given scenario, you would be called a mortgage broker. A mortgage broker is a professional who connects borrowers and lenders and helps them negotiate the terms of a mortgage loan.

In this case, you are introducing your friends who want to buy apartments to your friends who have money to lend, essentially acting as a middleman between them and helping them arrange a mortgage loan. A landlord is a person who owns a property and rents it out to tenants. Landlords typically collect rent payments from tenants and are responsible for maintaining the property. A loan officer is a professional who works for a bank or other financial institution and helps people apply for loans. Loan officers evaluate loan applications, review credit histories and income levels, and help borrowers understand the terms of the loan. A mortgagor is a person who borrows money to purchase a property and pledges the property as collateral for the loan. In other words, the mortgagor is the borrower who is responsible for paying back the mortgage loan to the lender.

To read more about mortgage, click on https://brainly.com/question/29897938

#SPJ1

Question:4

Krishna Furnishers Martstarted its operations in the year 1954 and emerged as the market leader in the industry

because oftheir original designs and efficiency in operations. They had a steadydemand fortheir products but overthe

years, they found their market share declining because of newentrants in the field. The firm decided to review their

operations and decided that in orderto meet the competition, they need to study and analyze the market trends and

then design and develop their products accordingly. List any two impacts of changes in business environmernt on

Krishna Furnishers Mart's operations. (Hint: increase in competition and Market orientation)

Answers

I own a candy store in my country. I am free to choose the products I sell and I am able to complete against other stories using innovative ideas. After a white selection of candies are various prices what type of economic system does my country most likely utilize

Answers

Answer:

The country most likely utilizes a free market economy.

Explanation:

A free market economy is characterized by the price system: in this system, prices signal economic activity in order to coordinate the forces of supply and demand in order to reach a market equilibrium.

In a free market economy, competition is stiff because firms can freely enter and exit the markets, and this also influences the price of goods and services.

Firms try to out-compete other firms by improving production processes, innovating, and lowering costs.

please please help. i need 2,3, and 4 . it is due tomorrow

Answers

Answer:

2. Filing for bankruptcy is when the court decides whether to discharge your debts and those who owe are no longer legally required to pay them. It is on a credit report because it shows what you can pay for and what you can't.

3.Pay Your Bills on Time, Pay off Debt and Keep Balances Low on Credit Cards, and apply for and Open New Credit Accounts as Needed.

4.TransUnion, Equifax, and Experian.

Explanation:

PLEASE HELP QUICKLY: (FIRST PERSON GETS BRAINLIEST)

Adalaide is considering switching cell phone plans. Though the new plan is slightly more each month, she’ll be able to get a new phone sooner. When making this financial decision, what should Adalaide keep in mind?

A. Only major financial commitments will affect your overall financial status.

B. Any small financial commitments will make no effect on your financial standing.

C. Both small and large financial decisions can influence your financial health.

Answers

Explanation:

Though the new plan is slightly more each month, she'll be able to get a new phone sooner. When making this financial decision, what should Adalaide keep in mind? Only major financial commitments will affect your overall financial status. Any small financial commitments will make no effect on your financial standing.

When making this financial decision Only major financial commitments will affect your overall financial status should Adalaide keep in mind. Thus, option A is correct.

What is a financial status?Financial status can be defined as the statement with States the income as well as expenses of a particular person's first stop clearly defined that the fund is being used for all updates. This gives the financial position of the individual or a company.

In this, as an Adalaide switched cell phone plant there is only a slide difference in the monthly plan but this will not affect in a very big or significant way the financial status of the financial structure for her overall new phone decision. As she can adjust us light expenses in other things or grocery.

Therefore, option A is the correct option.

Learn more about Financial status, here:

https://brainly.com/question/13198681

#SPJ2

What are the remedial measures of unemployment in nepal?explain

Answers

Soft skills 2 sentences that will help

Answers

Answer:

Include the terms most closely related to the job in your resume, especially in the description of your work history. Highlight Skills in Your Cover Letter: You can incorporate soft skills into your cover letter. Include one or two of the skills mentioned here, and give specific examples of instances when you demonstrated these traits at work

Explanation:

Great American Oil Change (GAO) sells a combined oil change service and parts package for $30. A customer who supplies the parts (oil and filter) is charged $20 for only the service, whereas a customer who buys only the oil and filter (for do-it-yourself use) is charged $20 for the parts. The parts cost GAO $14. Determine the dollar amount of revenue from the oil change service versus the sale of parts for each combined oil change package TIP: To calculate the percentage of the combined package that relates to the service, divide the stand-alone selling price of the service by the combined stand-alone selling prices of both the service and parts. Allocated Transaction Price Parts Service

Answers

Answer:

Oil change Service $15

Sales of Parts $15

Explanation:

Calculation to Determine the dollar amount of revenue from the oil change service versus the sale of parts for each combined oil change packages

First step

Oil change service= $20

Selling price of parts = $20

Total $40

Second step

Percentage of each activity in total Revenue

Oil change service = $20

Oil change service=20/40*100

Oil change service=50%

Sale of parts= $20

Sale of parts=20/40*100

Sale of parts=50%

Third step is to calculate the Allocated Transaction Price for both parts and service

Combine oil change service and part package = $30

Oil change service= $30 * 20/40

Oil change service=$15

Sale of parts = $30 * 20/40

Sale of parts= $15

Therefore the dollar amount of revenue from the oil change service is $15 and the sale of parts is $15

Selling price allocated for supply and service is $15 each

Allocation based problem;Given:

Service price = $20

Price of Oil and filter = $20

Combine service charges = $30

Computation:

In proportion to the standalone selling price, a combined selling price should indeed be apportioned between supply and services.

Selling price allocated for service = $30 × [20/40]

Selling price allocated for service = $30 × [0.5]

Selling price allocated for service = $15

Selling price allocated to supply = $30 × [20/40]

Selling price allocated to supply = $30 × [0.5]

Selling price allocated to supply = $15

Find out more information about 'supply and services'

https://brainly.com/question/11294117?referrer=searchResults

What is meant by the phrase “Keeping up with the Joneses”?

a

This phrase refers to the human behavior of wanting to spend more because we see others around us spending more and enjoying goods and services that we think we would enjoy as well.

b

This phrase refers to the concept of saving up for only your needs in your budget, not your wants.

c

This phrase refers to the annual event in August where investors compete with each other to see who can beat the market.

d

This phrase refers to the newest reality television show that demonstrates the effect of saving early and often.

Answers

Answer:

D This phrase refers to the newest reality television show that demonstrates the effect of saving early and often.

Explanation:

A reference to the reality show Keeping up with the Kardashians.

2. Management is essential for the organisations which are

(a) Non-profit organisations

(b) Service organisations

(c) Social organisations

(d) All of the above

Answers

Answer:

I'm not 100% sure but I think its D

The correct answer is D (i.e. all the above)

For the concept of Management, it is said that It is all-pervasive.

Here Pervasive means spread out and affecting all parts of something.

Management is all pervasive means it is required in all types of organizations whether it is social, service, NPO(i.e.non-profit organization), or any other business organization, And either it is big or small because it helps and directs various efforts towards a definite purpose.

Management is the process of work done by others. whenever there is the involvement of more than one person, Management is required.

Therefore, Management is essential for an organization which is a non-profit organization, also service organization, and also social organization.

learn more about MANAGEMENT:

brainly.com/question/28072798

How has banking changed in the past 200 years of our nation's history?

Answers

Banking has changed in the past 200 years of our nation's history because:

Everything is digitized and more efficientBanking is the institution which basically keeps money of its customers and allows them to perform financial transactions, collect overdrafts, send and receive money, give interests and many more.

As a result of this, we can see that there are differences in how banking was two hundred years ago and today. Back then, banking was not digitized as people exchanged money by hand and stored their money wherever they felt was safe for them.

Read more here:

https://brainly.com/question/19279356

Choose the era that best matches the statement given.

A company who has pleasing the customer in its mission statement

Answers

Answer:

Marketing company era

Explanation:

They need to get their product out there, so they use mission statements to please the customer, which is marketing.

An online clothing boutique decides to install a web or Internet cookie in the browser of each user who visits its site. The purpose of the cookie is to remember information about the user and help monitor-browsing patterns on their site and others. This enables the boutique's website to suggest products to the customer that match their browsing history. This is:

Answers

Answer:

a practice that may have longer term implications on the ethics of personal privacy

Explanation:

Cookies are a tool that is used on websites to identify user browser history.

The information on a user's browsing habits is then used by businesses to tailor display information relevant to what they are usually interested in.

Usually they are a safe way to improve browsing experience, but they can be used by criminals to spy on people and gain unwanted access to their data.

Cookies save information about a user session by storing data like usernames.

There is a long term danger of having one's browsing history tracked without their consent

The tax paid for land is known as

i)direct tax

ii)land revenue tax

iii)income tax

Answers

Answer:

land revenue tax

Explanation:

this is the money paid to make known that the land is yours

plssssssssssssssssssssssssssssssssssssssssss i need this asap

what is the most likely reason why a text-only billboard that is advertising a new vacuum cleaner not get a heavy consumer response?

a. bc the product is poor quality

b. bc the billboard isn't attention grabbing

c. bc the target audience won't see the billboards

d. bc no one buys vacuum cleaners anymore

Answers

Answer:

b

Explanation:

because it makes sense

Answer:

c

Explanation:

the most reasonable answer.

Karl’s Sporting Goods started as a small shop catering to the fly-fishing crowd but as requests were made for different and varied goods, it branched out into an outdoor-sports store. Karl caters to his core customer base of hunters and fishermen, but stocks the latest outdoor gear for those who want to incorporate other sports such as backpacking into their hunting and fishing experience. Due to space limitations, he does not carry mountain bikes, but does carry gear for them. Since Karl’s is not located near the ocean or a large body of water, he does not carry wetsuits or other watersports equipment, but he does carry gear that would be required for wading in cold mountain rivers and streams, and canoes and kayaks. His marketing is directed toward hunters and fishermen, but includes activities, events, and sales aimed at bringing outdoor enthusiasts with other interests into his store. Over the past month, he has received numerous request for rock climbing gear. As a result of t

Answers

The full question is:

Karl's Sporting Goods started as a small shop catering to the fly-fishing crowd but as requests were made for different and varied goods, it branched out into an outdoor-sports store. Karl caters to his core customer base of hunters and fishermen, but stocks the latest outdoor gear for those who want to incorporate other sports such as backpacking into their hunting and fishing experience. Due to space limitations, he does not carry mountain bikes, but does carry gear for them. Since Karl's is not located near the ocean or a large body of water, he does not carry wetsuits or other watersports equipment, but he does carry gear that would be required for wading in cold mountain rivers and streams, and canoes and kayaks. His marketing is directed toward hunters and fishermen, but includes activities, events, and sales aimed at bringing outdoor enthusiasts with other interests into his store. Over the past month, he has received numerous request for rock climbing gear. As a result of these requests, Karl has entered into negotiations with three providers of high-quality rock climbing shoes and gear. What do Karl's activities show about his marketing for Karl's Sporting Goods?

Answer:

He has a marketing concept and is acting on it.

Explanation:

A marketing concept is the way by which businesses identify the needs of customers and come up with strategic ways of meeting those needs better than competing firms.

Different marketing concepts include: production concept, product concept, selling concept, marketing concept, and the societal marketing concept.

In the given scenario Karl's sporting goods only catered for fly fishers but as demand for other items increased they branched into other outdoor sport items.

He is stocking gear for swimming, rock climbing, and mountain bikers through partnership with suppliers even if they are not his primary market.

This is acting on marketing concept to be able to meet demand for the other outdoor sporting activities he does not normally supply

Melissa is very good at her Revenue job. Which skills does Melissa most likely have?

performing specialized work to support an embassy

analyzing information from discussions or applications

public speaking and debating

reviewing and analyzing tax forms!

Answers

Answer:

reviewing and analyzing tax forms!

Explanation:

Revenue is the total value of goods and services sold by a business in a financial period. However, the revenue department or a revenue officer refers to civil servants who collect taxes and other revenues on behalf of the government.

Melisa could probably be working in a government agency tasked with collecting revenue, such as the US's IRS. If she is very good at her job, it means she is an expert in reviewing and analyzing tax forms.

Answer:

reviewing and analyzing tax forms

Explanation:

I copied the other dude

According to the video, which activities are Executive Secretaries and Administrative Assistants likely to do? Check all that apply. Supervise office staff, prepare presentations, conduct research, create a budget, file paperwork, greet visitors

Answers

Answer: supervise office staff

Prepare presentations

Conduct research

Explanation:

Answer:

Answer: supervise office staff

Prepare presentations

Conduct research

Explanation:

You decide to incorporate your bracelet business and get your mother and brother involved in the corporation. Your executive committee is made up of you as the president, your mother as the secretary, and your brother as the treasurer. The three of you are the key officers of the corporation, with you as the CEO, your mother as the head of HR, and your brother as the CFO. The Brady Business Friendship Bracelet (BBFB), Inc., conglomerate is ridiculously successful, earning the three key executives over $100,000 each in salary and bonuses. Before you begin operating, the BBFB decides to become an S Corp designation and to remain a closely held corporation. The state of incorporation is different from the principal place of business operations or the headquarters. The corporation cannot be sued there as well as in its home state.

True

False

Answers

Answer:

true

Explanation:

Answer:

false

Explanation:

The local recycling center sends a truck to the

school once a month to collect the paper that

was recycled. Each month, the truck picks up

642.3 pounds of paper. How much would the

truck pick up after 3 months?

Answers

Answer:

1,926.90 pounds

Explanation:

In one month, the trucks collect 642.3 pounds of paper.

After three months, the trucks will have collected.

=642.3 pounds multiplied by three months

=642.3 x 3

= 1,926.90 pounds